[ad_1]

Economists are urging People to refinance to make the most of traditionally low refinance charges. These low charges have been fueled by the Fed’s efforts to spice up the economic system and are usually not going to final for much longer.

Savvy householders are taking benefit and putting whereas the iron is scorching with a purpose to maximize their long-term financial savings.

Lock in your rate now, before the Fed meets

- Refinance rates are at historical lows: The Fed is artificially suppressing rates of interest with a purpose to preserve them low. Notice that these rate-suppressing packages may finish prior to anticipated. Jerome H. Powell, the central financial institution’s chair was just lately quoted saying “when the time comes to boost rates of interest, we will definitely try this”.

- Rates will rise: It’s inevitable and it’s only a matter of time earlier than charges will begin to rise once more. They may even rise the following time the Fed meets. Bob Broeksmit, President of the Mortgage Bankers Affiliation all however ensured they might rise stating that “with mortgage charges effectively under three p.c however anticipated to rise slowly this yr, many householders are appearing now.”

- It can save you a lot: On common, in January 2021, LendingTree customers saved over $38Okay on the lifetime of their mortgage by refinancing.

- Mortgage rates are tied to treasury bond prices: Which means that treasury bond yield traits may increase mortgage charges. If bond yields enhance, mortgage charges would additionally enhance, says Matthew Speakman, economist at Zillow.

- There is no risk and it’s free to look: By utilizing LendingTree, you possibly can examine charges tailor-made to you and see how a lot it can save you totally free. Our straightforward to make use of kind solely takes 2 minutes and there’s no exhausting credit score pull.

When lenders compete you win. Get matched with as much as 5 affords and calculate your new cost. Moreover, a latest research confirmed that buying round can have extra of an impact on a price than a purchaser’s credit score rating or down cost. Don’t miss out on this refinance alternative and at last verify off mortgage financial savings out of your to-do checklist.

Right here’s learn how to get began:

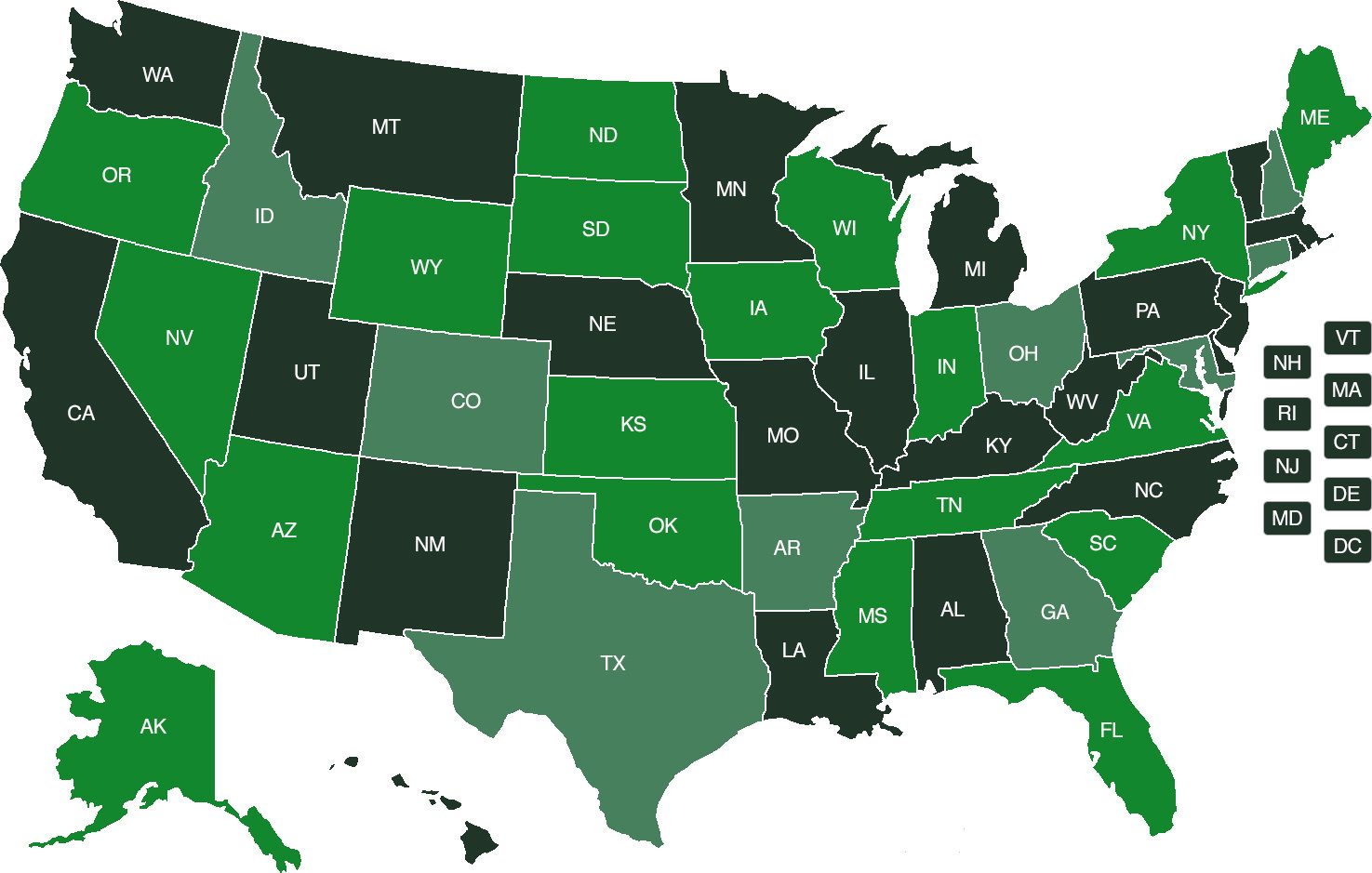

Step 1: Get began by clicking the map under.

Step 2: When you undergo just a few questions, you should have the chance to check the quotes from a number of lenders!

Source link