[ad_1]

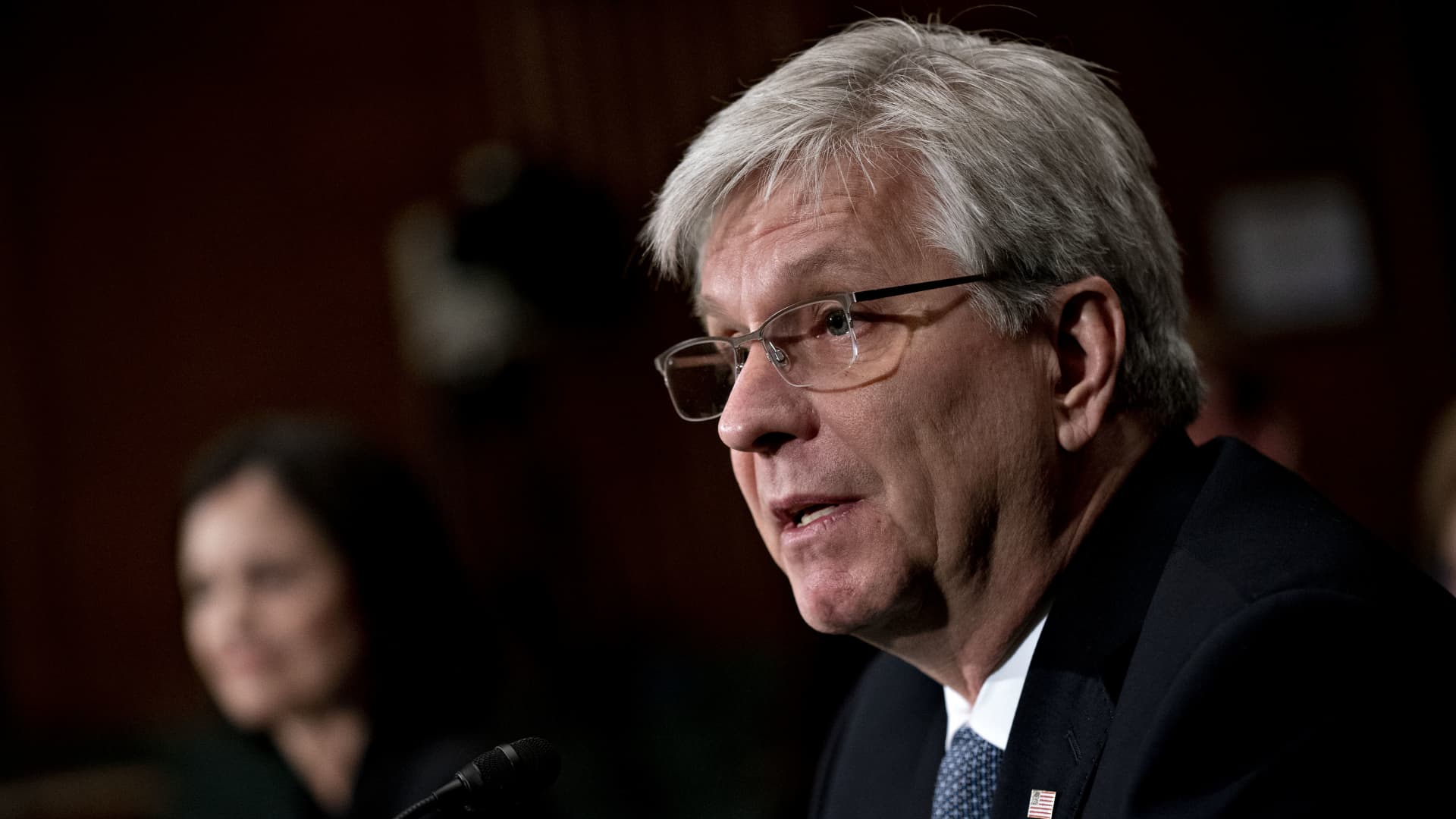

Christopher Waller, U.S. President Donald Trump’s nominee for governor of the Federal Reserve, speaks throughout a Senate Banking Committee affirmation listening to in Washington, D.C., U.S, on Thursday, Feb. 13, 2020.

Andrew Harrer | Bloomberg | Getty Photographs

Federal Reserve Governor Christopher Waller mentioned he is prepared to contemplate what can be essentially the most aggressive rate of interest hike in a long time on the central financial institution’s assembly later this month.

Whereas Waller mentioned he helps a 75 foundation level hike on the July 26-27 assembly, he shall be watching knowledge and protecting an open thoughts about what the Fed ought to do to regulate inflation, which is operating at its quickest tempo since 1981.

“My base case for July relies on incoming knowledge,” he mentioned in remarks at an occasion in Victor, Idaho. “We now have vital knowledge releases on retail gross sales and housing coming in earlier than the July assembly. If that knowledge is available in materially stronger than anticipated, it might make me lean in the direction of a bigger hike on the July assembly to the extent it exhibits demand shouldn’t be slowing down quick sufficient to get inflation down.”

Following Wednesday’s consumer price index data exhibiting 12-month inflation at 9.1%, markets started pricing in a full percentage point, or 100 foundation level, improve within the Fed’s benchmark short-term borrowing fee. The chance for that consequence stood at practically 80% Thursday morning, in response to CME Group knowledge.

If the Fed would go the 100 foundation level route, it might mark the most important one-month improve for the reason that early 1980s when the central financial institution was making an attempt to regulate runaway inflation.

Getting costs down is the paramount mission of the Fed now, mentioned Waller, who expects nonetheless extra fee hikes even after this month’s.

“I believe we have to transfer swiftly and decisively to get inflation falling in a sustained approach, after which think about what additional tightening shall be wanted to attain our twin mandate,” he mentioned.

Whereas he expressed robust concern about inflation, Waller was extra optimistic in regards to the economic system.

Worries are mounting that the U.S. is headed for or already in a recession, however Waller mentioned the power of the roles market has him “feeling pretty assured that the U.S. economic system didn’t enter a recession within the first half of 2022 and that the financial growth will proceed.”

Even with the Fed tightening, he mentioned he thinks the economic system can obtain a “smooth touchdown” that will not embrace a recession. U.S. GDP contracted 1.6% within the first quarter, and the Atlanta Fed’s GDPNow tracker is indicating a 1.2% decline in Q2, assembly the rule-of-thumb definition of a recession.

Source link