[ad_1]

Getty Photos

The quantity of cryptocurrency flowing into privacy-enhancing mixer providers has reached an all-time excessive this 12 months as funds from wallets belonging to government-sanctioned teams and legal exercise virtually doubled, researchers reported on Thursday.

Mixers, also referred to as tumblers, obfuscate cryptocurrency transactions by making a disconnect between the funds a person deposits and the funds the person withdraws. To do that, mixers pool funds deposited by massive numbers of customers and randomly combine them. Every person can withdraw your complete quantity deposited, minus a minimize for the mixer, however as a result of the cash come from this jumbled pool, it is tougher for blockchain investigators to trace exactly the place the cash went.

Important money-laundering danger

Some mixers present further obfuscation by permitting customers to withdraw funds in differing quantities despatched to totally different pockets addresses. Others attempt to conceal the blending exercise altogether by altering the payment on every transaction or various the kind of deposit tackle used.

Mixer use is not robotically unlawful or unethical. Given how simple it’s to trace the stream of Bitcoin and another kinds of cryptocurrency, there are legit privateness causes anybody would possibly need to use one. However given the rampant use of cryptocurrency in on-line crime, mixers have advanced as a must-use software for criminals who need to money out with out being caught by authorities.

“Mixers current a troublesome query to regulators and members of the cryptocurrency neighborhood,” researchers from cryptocurrency evaluation agency Chainalysis wrote in a report that linked the surge to elevated volumes deposited by sanctioned and legal teams. “Nearly everybody would acknowledge that monetary privateness is effective, and that in a vacuum, there is no motive providers like mixers should not be capable to present it. Nonetheless, the information exhibits that mixers at present pose a big cash laundering danger, with 25 % of funds coming from illicit addresses, and that cybercriminals related to hostile governments are taking benefit.”

The report added: “Mixers might quickly grow to be out of date as Chainalysis continues to refine the flexibility to demix sure mixing transactions and see customers’ unique supply of funds. However in the intervening time, our information exhibits that mixers are receiving extra cryptocurrency than ever in 2022.”

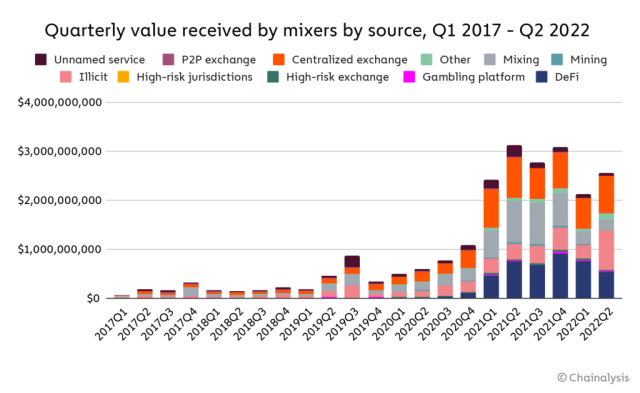

Cryptocurrency obtained by these mixers fluctuates considerably from each day, so researchers discover it extra helpful to make use of longer-term measures. The 30-day transferring common of funds obtained by mixers hit $51.eight million in mid-April, an all-time excessive, Chainalysis reported. The high-water mark represented virtually double the incoming volumes on the similar level final 12 months. What’s extra, illicit pockets addresses accounted for 23 % of funds despatched to mixers this 12 months, up from 12 % in 2021.

Rogues’ gallery

Because the graph under illustrates, the will increase come most notably from increased volumes despatched from addresses related to illicit exercise, similar to ransomware assaults, cryptocurrency scams, and stolen funds carried out by teams sanctioned by the US authorities. To a lesser extent, volumes despatched from centralized exchanges, DeFi, or decentralized finance protocols, additionally drove the surge.

Chainalysis

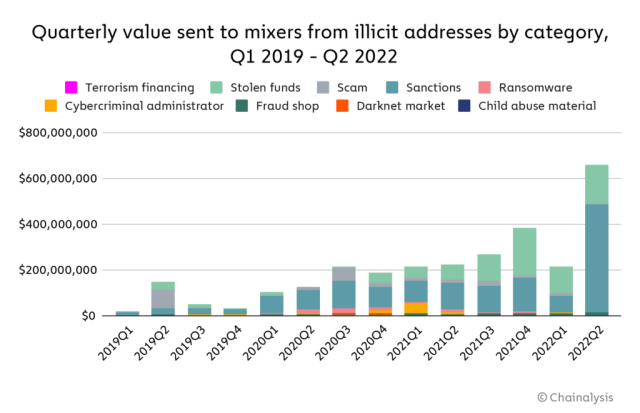

A breakdown of volumes related to illicit sources exhibits that the spike is pushed primarily by sanctioned entities—primarily Russian and North Korean in origin—adopted by cryptocurrency thieves and fraudsters pushing cryptocurrency funding scams.

Chainalysis

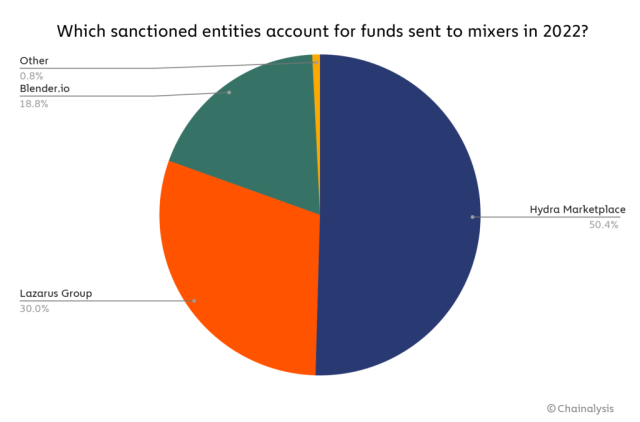

The sanctioned entities are led by Hydra, a Russia-based darkish net market that serves as a haven for criminals to purchase and promote providers and merchandise to 1 one other. In April, the US Division of Treasury sanctioned Hydra to stymie the group’s efforts to liquidate their ill-gotten proceeds. The remaining quantity from sanctioned teams got here from the North Korean hacking group Lazarus and the Blender.io tumbler, which the US Treasury Division sanctioned earlier this year for serving the North Korean authorities.

Chainalysis

Regardless of their utility, mixers undergo a crucial Achilles’ heel: Giant transactions make them ineffective, which means that they work much less effectively when folks use them to deposit massive quantities of cryptocurrency.

“Since customers are receiving a ‘combine’ of funds contributed by others, if one person floods the mixer and contributes considerably greater than others, a lot of what they find yourself with shall be made up of the funds they initially put in, making it attainable to hint the funds again to their unique supply,” Thursday’s report defined. “In different phrases, mixers operate finest after they have numerous customers, all of whom are mixing comparable quantities of cryptocurrency.”

Publish up to date to right description of Blender.io.

Source link