[ad_1]

© Reuters.

By Ambar Warrick

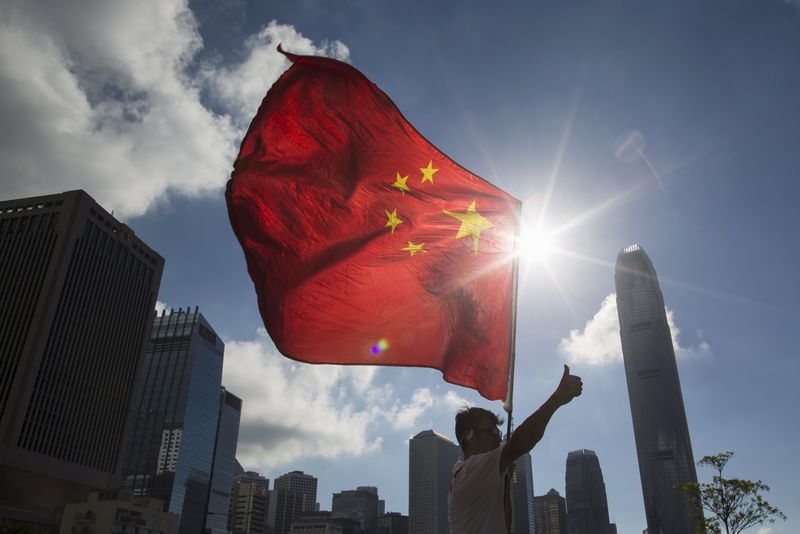

Investing.com– Most Asian currencies recovered sharply from latest losses on Tuesday regardless of hawkish indicators from the Federal Reserve, with focus remaining squarely on COVID-related protests in China and the federal government’s response.

The rose 0.4% to 7.1792 towards the greenback, recovering from a virtually three-week low hit within the prior session, whereas the jumped 0.8%.

Civilian protests towards the federal government’s strict zero-COVID insurance policies appeared to have simmered down after escalating over the weekend. Considerations over extra financial disruptions from the protests prompted deep declines in markets on Monday, though markets stabilized from their losses later within the session.

Some analysts opined that the protests might additionally push the federal government into finally scaling again its zero-COVID policy- a state of affairs that’s largely optimistic for Chinese language and broader Asian markets. However on condition that the nation is grappling with a record-high every day improve in infections, probabilities of a zero-COVID reversal within the near-term seem slim.

Beijing additionally rolled out extra stimulus measures concentrating on the true property sector, which supported sentiment in direction of the nation and boosted native shares.

Broader Asian currencies tracked a restoration in Chinese language markets, dismissing hawkish feedback from two Federal Reserve officers that advised that U.S. rates of interest will keep excessive till properly into 2022. The added 0.4%, whereas the led beneficial properties throughout Asia with a 1.2% soar.

The and fell 0.4% on Tuesday, however hovered above the 106 stage, retaining some beneficial properties made within the prior session as considerations over China drove up secure haven demand.

However an at the moment are betting towards the greenback on the notion that U.S. inflation has peaked, warranting by the Fed.

Fed members have signaled that future price motion will largely depend upon inflation, which is at the moment trending properly above the Fed’s 2% annual goal. Focus this week is on an deal with by on Wednesday, in addition to on Friday.

The rose 0.2%, whilst information for October missed market expectations, heralding extra stress on the world’s third-largest financial system. Expectations of a dovish Fed have benefited the forex in latest weeks.

Amongst Antipodean currencies, the jumped 0.8%, whereas the added 0.7%.

Source link