Based mostly on 19 bear markets within the final 140 years, this is the place the present downturn could finish, says Financial institution of America

[ad_1]

At almost the midway mark in a unstable 12 months of buying and selling, the S&P 500 index is down, however not out to the purpose of an official bear market but.

Based on a extensively adopted definition, a bear market happens when a market or safety is down 20% or extra from a current excessive. The S&P 500

SPX,

is off 13.5% from a January excessive of 4,796, which for now, simply means correction territory, usually outlined as a 10% drop from a current excessive. The battered Nasdaq Composite

COMP,

in the meantime, is at the moment down 23% from a November 2021 excessive.

That S&P bear market debate is raging nonetheless, with some strategists and observers saying the S&P 500 is growling identical to a bear market ought to. Wall Avenue banks like Morgan Stanley have been saying the market is getting close to that point.

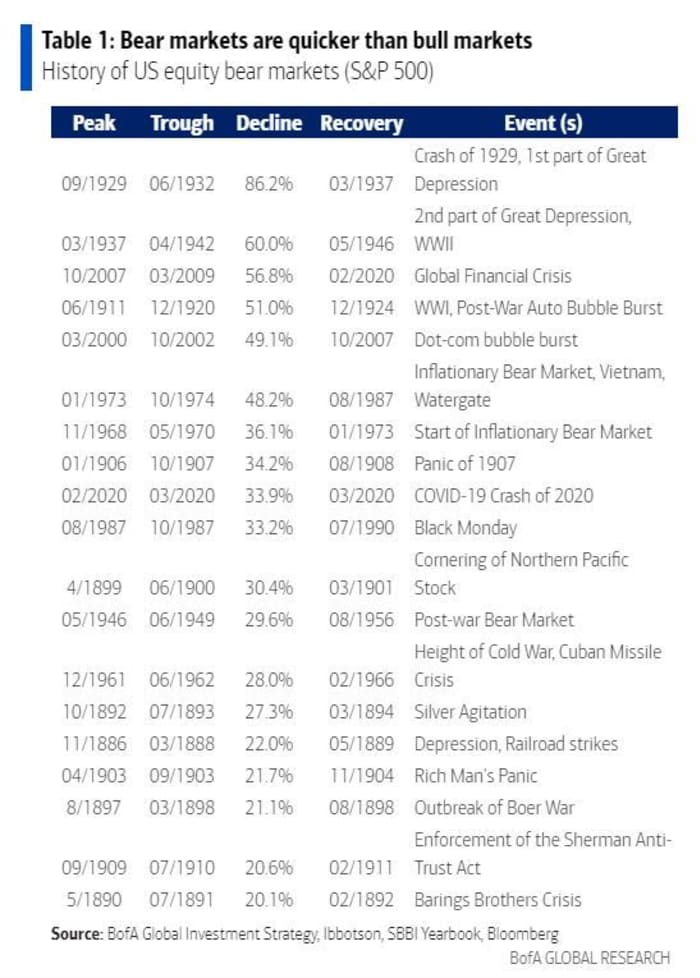

However ought to the S&P 500 formally enter the bear’s lair, Financial institution of America strategists led by Michael Hartnett, have calculated simply how lengthy the ache may final. a historical past of 19 bear markets over the previous 140 years, they discovered the typical value decline was 37.3% and the typical period about 289 days.

Whereas “previous efficiency isn’t any information to future efficiency,” Hartnett and the workforce say the present bear market would finish Oct. 19 of this 12 months, with the S&P 500 at 3,000 and the Nasdaq Composite at 10,000. Take a look at their chart beneath:

BofA World Analysis

The “excellent news,” is that many shares have already reached this level. with 49% of Nasdaq constituents greater than 50% beneath their 52-week highs, and 58% of the Nasdaq greater than 37.3% down, with 77% of the index in a bear market. Extra excellent news? “Bear markets are faster than bull markets,” say the strategists.

The financial institution’s newest weekly knowledge launched on Friday, confirmed one other $3.Four billion popping out of shares, $9.1 billion from bonds and $14 billion from money. They observe a lot of these strikes have been “threat off” headed into the current Federal Reserve assembly.

Whereas the Fed tightened policy as expected again this week, uncertainty over whether or not its stance is any much less hawkish than beforehand believed, together with considerations that the central financial institution could not be capable to tighten coverage with out triggering an financial downturn, left shares dramatically weaker on Thursday, with more selling under way on Friday.

The strategists provide up one last factoid that will additionally give traders some consolation. Hartnett and the workforce famous that for each $100 invested in equities over the previous 12 months or so, solely $Three has been redeemed.

As properly, the $1.1 trillion that has flowed into equities since January 2021 had a mean entry level of 4,274 on the S&P 500, that means these traders are “underwater however solely considerably,” mentioned Hartnett and the workforce.

Source link