[ad_1]

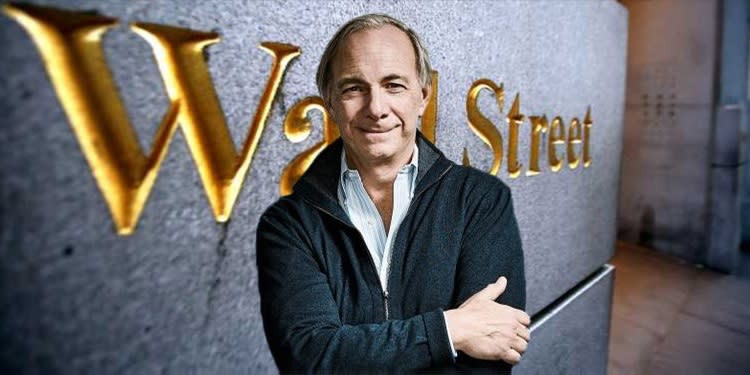

When legends communicate, individuals hear – and few traders match the legendary standing of Ray Dalio. The founding father of Bridgewater Associates has constructed his agency from a 2-room house operation into the world’s largest hedge fund, with greater than $150 billion in property beneath administration, and a internet achieve exceeding $46 billion.

Dalio believes that the following two to 4 years will see our world financial and political programs change in methods which can be unpredictable now. And the important thing to survival, for traders, could also be a wide-ranging stance in shares. As Dalio says, “I need a extremely diversified portfolio of property that aren’t money and bonds. I need geographic diversification as a lot as I need asset class diversification.”

Bearing this in thoughts, our focus shifted to Bridgewater’s most up-to-date 13F submitting, which discloses the shares the fund snapped up within the first quarter. Locking in on two tickers specifically, TipRanks’ database revealed that every has earned a “Robust Purchase” analyst consensus and boasts vital upside potential.

These are new positions for Bridgewater which will shed some mild on the place Dalio needs to go because the market local weather turns stormy. Let’s take a better look.

The Magnificence Well being Firm (SKIN)

We’ll begin within the self-care sector, with the Magnificence Well being Firm. Magnificence Well being owns and distributes a spread skincare and beauty manufacturers, together with its flagship model, HydraFacial. The corporate take a health-centered method, selling wholesome pores and skin as the basis of magnificence; it’s merchandise fill the hole between conventional cosmetics and medicinal pores and skin remedies.

Magnificence Well being entered the general public markets by way of a billion-dollar SPAC merger in 2021, and has been making one thing of a splash. The corporate reported $260.1 million in internet gross sales for HydraFacial final 12 months, and noticed its buyer base broaden to 21,719 put in HydraFacial supply programs in additional than 90 nations. In March of this 12 months, the corporate launched a digitized improve to the HydraFacial supply system, dubbed Syndeo, and noticed 258 trade-ups to the brand new system earlier than the tip of Q1.

The corporate had different excellent news in 1Q22. Revenues expanded year-over-year, rising 58% to greater than $75.four million and the corporate reported a well being combine in that whole, with $33.eight million from consumables and $41.6 million from supply programs. Magnificence Well being additionally boasts an enviable gross margin of 69%, boding effectively for the corporate’s means to advance towards profitability. Nonetheless, regardless of the corporate’s rising income image, the inventory is down by roughly half up to now this 12 months.

Ray Dalio seems to see the low share value as a chance. His Bridgewater agency made a big purchase in SKIN shares, totaling 255,552 shares. On the present market value, this bloc is price $3.07 million.

5-star analyst Kyle Rose, of funding agency Canaccord, additionally sees loads of purpose for an upbeat outlook right here. He writes, “SKIN reported yet one more spectacular print with the launch of the next-generation Syndeo platform underway…. SKIN views 2022 as its last funding 12 months, as the corporate continues to scale infrastructure and spend money on the continued launch of Syndeo… Whereas some traders stay frightened concerning the near-term margin impression of trade-ins/upgrades to Syndeo, we imagine the corporate continues to prudently spend money on key close to/long-term development initiatives that ought to lay a powerful basis from which it could actually harvest leverage in subsequent years (in 2023+). We see no purpose to alter our thesis given optimistic underlying momentum within the enterprise.”

That thesis is a Purchase ranking on the inventory which comes together with a $22 value goal. If right, traders may very well be lining their pockets with an 83% achieve.(To look at Rose’s monitor file, click here)

Clearly, the bulls are out in pressure for this beauty model – SKIN has a unanimous Robust Purchase consensus ranking based mostly on eight optimistic analyst opinions. The inventory is presently priced at $12.02 and its common value goal of $23.13 implies a strong 92% upside for the following 12 months. (See SKIN stock forecast on TipRanks)

Trimble Navigation (TRMB)

Now let’s shift our gears to an industrial tech firm, Trimble Navigation. Trimble, based mostly in Sunnyvale, California, offers software program, {hardware}, and help providers to a variety of industries, together with agriculture, constructing and development, geospatial, authorities, transportation, and utilities, geared toward bettering effectivity by linked the bodily and digital worlds. Among the many firm’s merchandise are world navigation satellite tv for pc system receivers, inertial navigation programs, laser rangefinders, unmanned aerial autos, scanners, and software program processing instruments.

In current weeks, Trimble has accomplished a transfer to streamline its personal operations going ahead. The corporate divested 4 subsidiary companies to Precisional, one of many associates of The Jordan Firm. Precisional is an industrial precision measurement agency; the divisions it picked up have been Protempis, Spectra Precision Instruments, LOADRITE, and SECO. The monetary phrases of the transaction weren’t disclosed.

Just a few days previous to the divestment announcement, Trimble launched its 1Q22 monetary outcomes – and confirmed a quarterly file in whole income. At $993.7 million, the highest line was up 12% year-over-year. Annualized recurring income (ARR) additionally grew 12%, and reached $1.47 billion. The corporate reported non-GAAP internet revenue of $184.eight million, which translated to a non-GAAP EPS of 73 cents. On a per-share foundation, this revenue was up from 66 cents in 1Q21 – and beat the 68-cent forecast.

Ray Dalio should have favored what he noticed right here, as a result of Bridgewater purchased in to the tune of 143,439 shares. This new place is price $9.32 million at present buying and selling ranges.

Piper Sandler’s 5-star analyst Weston Twigg can be optimistic on Trimble trying ahead, saying ‘it has not seen any recessionary indicators.’ Stepping into particulars, Twigg goes on to put in writing, “Income in Buildings & Infrastructure and Assets & Utilities have been considerably above our estimates, reflecting power in development and agriculture. With respect to present occasions, TRMB has reduce off HW gross sales to Russia/Belarus (roughly 2% of income), however it’s redirecting these gross sales to different prospects in backlog, so it ought to see restricted impression in 2022; associated will increase in commodity meals costs might create longer-term tailwinds as agricultural demand picks up elsewhere.”

“We imagine TRMB is making vital progress towards its software-centric, higher-margin gross sales mannequin, demonstrated by robust traction with its recently-launched Trimble Development One platform, which is cloud-based, bundled development administration SW,” Twigg summed up.

These feedback help Twigg’s Obese (i.e. Purchase) ranking on the inventory, and his $100 value goal signifies room for ~54% share development forward. (To look at Twigg’s monitor file, click here)

Typically, the remainder of the Avenue has an optimistic view of TRMB. The inventory’s Robust Purchase standing comes from the three Buys and 1 Maintain issued over the earlier three months. Shares in TRMB are promoting for $65.03 every, and the typical goal of $83.75 signifies a attainable upside of ~29% from that stage.(See TRMB stock forecast on TipRanks)

To seek out good concepts for shares buying and selling at engaging valuations, go to TipRanks’ Best Stocks to Buy, a newly launched instrument that unites all of TipRanks’ fairness insights.

Disclaimer: The opinions expressed on this article are solely these of the featured analysts. The content material is meant for use for informational functions solely. It is vitally necessary to do your individual evaluation earlier than making any funding.

Source link