[ad_1]

Germany has been dealt a recent financial blow after the Rhine River dropped beneath a crucial degree, halting the transit of huge quantities of river site visitors.

The Rhine River fell to a brand new low on Friday, additional hindering the provision of important commodities to components of inland Europe because the continent battles with its worst vitality disaster in a long time. 400,000 barrels a day of oil merchandise are transported down the river, which stretches from the Amsterdam-Rotterdam-Antwerp area via Germany to Switzerland.

The water degree at Kaub – a key waypoint west of Frankfurt – dropped beneath the crucial 40 centimetres and is anticipated to proceed dwindling over the approaching days, based on German authorities knowledge.

The 40-centimetre marker means it’s not economical for a lot of barges to transit the river.

Shallow water prevents barges from loading their full volumes. Low water often impacts site visitors on the Rhine, however this 12 months it has reached a degree not seen since 1993.

By early Tuesday, the marker on the waypoint is anticipated to fall to 34 centimetres. The extent is a measure of navigability, not the precise depth of the river.

The Rhine is a key delivery route for Europe, which is presently struggling to safe vitality provides following Russia’s battle in Ukraine.

In Germany, firms have been taking steps to arrange. Chemical maker BASF is utilizing extra rail to move items and has ordered shallow-water barges. Whereas there isn’t any influence presently, the corporate has stated it can not rule out a discount in manufacturing charges for some crops within the coming weeks.

Utility Uniper stated on Thursday it won’t be able to convey sufficient coal by prepare to run its crops at full capability for an extended time period. It beforehand warned of manufacturing cuts at its Staudinger-5 plant till September as a result of an absence of coal.

Steelmaker Thyssenkrupp has stated its disaster workforce is assembly every day, and it’s utilizing ships with decrease drafts to maintain its mill within the city of Duisburg provided.

05:00 PM

5 Chinese language state-owned firms to delist from NYSE amid tensions

5 Chinese language state-owned firms, together with oil big Sinopec and China Life Insurance coverage, have introduced plans to delist from the New York Inventory Change, amid financial and diplomatic tensions with the US.

The businesses, which additionally embrace Aluminium Company of China (Chalco), PetroChina and Sinopec Shanghai Petrochemical Co, every stated that they’d apply to delist their American Depository Shares this month.

The 5, which in Could have been flagged by the US securities regulator as failing to satisfy its auditing requirements, will hold their listings in Hong Kong and mainland Chinese language markets.

Beijing and Washington are in talks to resolve a long-running audit dispute that would see Chinese language firms banned from US exchanges if they don’t adjust to US guidelines.

04:37 PM

Spain, Portugal welcome Germany’s name for Europe fuel hyperlink

Spain and Portugal backed Germany’s name for a fuel pipeline linking the Iberian peninsula with central Europe right this moment, with Madrid saying its a part of the connection might be “operational” inside months.

The proposal got here as Europe struggles to search out methods to quickly cut back its vitality dependence on Russia following its invasion of Ukraine, which has upended the facility market, sending costs hovering and nations scrambling for provides.

On Thursday, German Chancellor Olaf Scholz stated a pipeline operating via Portugal, Spain and France to central Europe was “conspicuously absent” and if it existed, it may make “a large contribution” to easing the provision disaster.

Spain presently has six liquefied pure fuel (LNG) terminals for processing fuel that arrives by sea which may assist the EU enhance imports, however solely has two, low-capacity hyperlinks to France’s fuel community, which has connections to the remainder of Europe.

04:01 PM

Meditation app Calm cuts 20computer of employees as Covid psychological well being growth cools

A meditation app based by a British entrepreneur has slashed 20computer of jobs because the Covid-fuelled growth for psychological well being applied sciences cools. Matthew Area writes:

Mindfulness app Calm, based by Michael Acton Smith, will lower 90 jobs amid a wider tech downturn.

San Francisco-headquartered Calm developed an app that claims to cut back stress and enhance sleep via meditation workout routines. It has signed up celebrities together with Matthew McConaughey, Cillian Murphy and LeBron James to voice its audio guides. Customers pay £28.99 per 12 months to make use of its instruments.

03:42 PM

London-listed HydrogenOne invests in Dutch pipeline firm

Funding fund HydrogenOne has invested £8.4m in a Dutch hydrogen firm, alongside among the world’s greatest firms.

The funding is a part of a £12m funding spherical which suggests it’s going to be a part of Shell Ventures and Chevron Know-how Ventures as buyers in Strohm.

The enterprise focuses on constructing pipelines that may pump hydrogen from offshore wind farms, the place it has been made utilizing clear vitality, to the shore. Hydrogen is touted by many as a clean-burning gas. Nevertheless, critics say that burning it nonetheless releases dangerous emissions – simply not carbon – and when it leaks into the environment the fuel can contribute to local weather change.

03:21 PM

Submit Workplace employees to take industrial motion too

In additional information from the CWU, employees on the Submit Workplace will take their fourth spherical of business motion on August 26, to coincide with a walkout by some employees at Royal Mail on the identical day.

It stated round 2,000 employees together with these in provide chain and administrative grades would strike in an “everyone-out” day on August 26 in a dispute over pay, after employees got no pay rise for 2021/22 and a 3pc provide for 2022/23.

Members in numerous Submit Workplace features will then maintain additional separate 24-hour walkouts, on August 27 and August 30, the union stated.

CWU assistant secretary Andy Furey stated: “At a time when inflation is sort of 12computer, a pay deal value simply 3pc over two years is extremely insulting – it’s really an enormous pay lower in actual phrases.”

02:59 PM

BT Group and Openreach employees announce extra strikes

The Communication Staff Union (CWU) has served discover on BT Group and Openreach that its members would take additional strike motion on August 30 and 31 in a dispute over pay.

Greater than 40,000 of BT’s employees walked out on July 29 and August 1, the primary strike motion in 35 years on the telecoms group. The corporate awarded a £1,500 pound-a-year rise in April, a 5pc improve on common, and has stated it will not be reopening its 2022 pay evaluate.

A spokesman for BT stated: “We now have made the very best pay award we may and we’re in fixed discussions with the CWU to discover a method ahead from right here. Within the meantime, we’ll proceed to work to minimise any disruption and hold our prospects and the nation related.”

02:59 PM

BT Group and Openreach employees announce extra strikes

The Communication Staff Union (CWU) has served discover on BT Group and Openreach that its members would take additional strike motion on August 30 and 31 in a dispute over pay.

Greater than 40,000 of BT’s employees walked out on July 29 and August 1, the primary strike motion in 35 years on the telecoms group. The corporate awarded a £1,500 pound-a-year rise in April, a 5pc improve on common, and has stated it will not be reopening its 2022 pay evaluate.

A spokesman for BT stated: “We now have made the very best pay award we may and we’re in fixed discussions with the CWU to discover a method ahead from right here. Within the meantime, we’ll proceed to work to minimise any disruption and hold our prospects and the nation related.”

CWU assistant secretary Andy Furey stated: “At a time when inflation is sort of 12computer, a pay deal value simply 3pc over two years is extremely insulting – it’s really an enormous pay lower in actual phrases.”

02:54 PM

Handover

It’s for me at hand over to the one and solely Giulia Bottaro, who will steer the weblog bravely unto the weekend. Thanks for following alongside right this moment!

02:38 PM

Rhine hits 40cm

Simply in: water ranges at Kaub, the essential waypoint within the Rhine, have fallen to the crucial degree of 40cm. That may go away the river impassable for a lot of barges, a serious blow of companies that use it for provides.

02:27 PM

Warning over vitality invoice stealth cost

Households chopping again on fuel and electrical energy use to save cash are being stung by “standing expenses” which can be utilized irrespective of how a lot vitality they use.

My colleague Tom Haynes experiences:

Standing expenses – also called ‘every day unit charges’ – are set by vitality firms, and are added to prospects’ payments at a flat charge.

Talking on BBC’s At this time programme, Emely Seymour, an vitality skilled at Which?, stated excessive standing expenses have been irritating to households who have been being charged regardless of their try to save cash via diminished utilization.

Standing expenses are included into the worth cap, set by the vitality watchdog Ofgem, which limits the quantity suppliers can cost prospects on variable tariffs.

However charges can fluctuate throughout the nation, which means these residing in areas such because the South West, the place transporting electrical energy is extra pricey, pay greater than those that reside in areas like London.

01:50 PM

Schroeder sues to reclaim Bundestag workplace

Gerhard Schroeder, Germany’s former chancellor, is suing the Bundestag to reclaim he government-funded workplace and employees – which have been taken away after he refused to chop ties with Vladimir Putin.

Bloomberg experiences:

Michael Nagel, Schroeder’s lawyer, claimed the choice by lawmakers within the Bundestag to droop the suitable to his workplace lacked any authorized foundation.

“These sort of choices, that are paying homage to a absolutist principality, can’t prevail below the rule of regulation,” Nagel stated in a press release. “The choice is bigoted.”

Schroeder, a Social Democrat like present Chancellor Olaf Scholz, led a ruling coalition in Berlin from 1998 to 2005. As soon as out of workplace, Schroeder’s shut ties to Putin and refusal to surrender profitable posts with Russian state-owned vitality firms turned a humiliation for his social gathering.

01:31 PM

Wall Road set to open greater

Nearly an hour till the US open, and it’s feeling loads like a Friday in mid-August round right here.

Wall Road shares are set to rise – futures are pointing to features of about 0.4pc on the benchmark S&P 500.

The gauge remains to be roughly 12.3pc beneath its January peak, though UK buyers who personal US shares will likely be feeling the ache of that fall considerably much less due to the stoop within the worth of the pound since then.

01:10 PM

European fuel set for fourth weekly achieve as disaster grows

European pure fuel costs – that are on the coronary heart of the vitality omnicrisis dealing with the continent – are set to notch up a fourth week of consecutive features.

Dutch front-month futures, the European benchmark, have dipped barely right this moment however are nonetheless up on the week.

Nations are scrambling to construct fuel reserves amid fears Vladimir Putin will flip off the faucets this winter.

12:09 PM

Half of England to be moved into drought standing

Greater than half of England are to be moved into drought standing, the Division for Surroundings, Meals and Rural Affairs stated.

My colleague Emma Gatten experiences:

Eight of 14 areas in England will likely be declared in drought standing: Devon and Cornwall, Solent and South Downs, Kent and South London, Herts and North London, East Anglia, Thames, Lincolnshire and Northamptonshire, East Midlands.

Yorkshire and the West Midlands are anticipated to maneuver into drought later in August.

11:24 AM

EU president Czechia floats ban on Russia visas

Czechia, which holds the European Union presidency, has reportedly floated the concept of a blanket ban of visas for Russian residents as a brand new escalation within the sanctions battle with Moscow.

An announcement by Prague’s overseas minister Jan Lipavsky, obtained by AFP, says:

The flat halting of Russian visas by all EU member states might be one other very efficient sanction.

In a time of Russian aggression, which the Kremlin retains on escalating, there can’t be talks about widespread tourism for Russian residents.

Such a transfer has additionally been supported by Finland and Estonia, whose prime minister tweeted earlier this week:

11:06 AM

Magic truffles face Dutch tax blow

Little bit of an offbeat summer time tax story: the ‘magic truffles’ offered in some Amsterdam outlets, face being slapped with a 21computer worth added tax after judges dominated they don’t depend as meals.

Per Dutch News:

The case was taken to courtroom by a truffle vendor who stated his merchandise ought to fall below the 9pc btw charge which covers meals. Truffles had fallen below the low charge since they first went on sale in 1997, however in 2019, the tax workplace stated they need to be charged on the regular, greater charge.

Within the new courtroom ruling, printed final week, judges say that the truffles are a stimulant and will subsequently fall below the identical btw ranking as alcohol and tobacco merchandise.

10:57 AM

Pound stumbles regardless of GDP beat

Sterling’s having a reasonably poor day right this moment, regardless of UK progress coming in stronger than anticipated.

As ever, it’s most likely value trying to the US aspect for a cause – this would possibly properly be an unwinding of among the losses the {dollars} suffered earlier this week as buyers pared again bets on Federal Reserve charge will increase following softer-than-expected inflation.

10:36 AM

Flutter mulling as much as 200 job cuts in UK and Eire, boss warns

Flutter shares are persevering with to soar right this moment following its upbeat earnings, however there’s a sting within the tail for workers: boss Peter Jackson says as many as 200 jobs within the UK and Eire could also be lower because it evaluations operations.

Some employees might be relocated to extra worthwhile components of the enterprise, he added, saying the evaluate is anticipated to conclude by the top of the subsequent month.

10:11 AM

Authorities plots new aid for energy-intense industries

The Authorities has launched a session method of supporting energy-intensive industries corresponding to metal, paper and cement.

In a press release, the Division for Enterprise, Power and Industrial Technique stated:

The UK Authorities is consulting on the choice to extend the extent of exemption for sure environmental and coverage prices from 85computer of prices as much as 100computer.

This displays greater UK industrial electrical energy costs than these of different international locations together with in Europe, which may hamper funding, competitors and business viability for lots of of companies in industries together with metal, paper, glass, ceramics, and cement, and threat them relocating from the UK.

BEIS stated this could assist “round 300 companies supporting 60,000 jobs within the UK’s industrial heartlands”.

Enterprise secretary Kwasi Kwarteng stated:

With world vitality costs at report highs, it’s important we discover what extra we will do to ship a aggressive future for these strategic industries so we will lower manufacturing prices and shield jobs throughout the UK.

10:04 AM

Eurozone factories stronger than anticipated

Simply in: industrial manufacturing within the eurozone rose 0.7pc in June, and was stronger than beforehand thought in Could (revised to +2.1pc, versus +0.8pc on an earlier estimate).

It’s an upbeat signal that defies wider worries a couple of slowdown pushed by the vitality disaster gripping the continent.

09:57 AM

ICYMI: Truss guidelines out windfall tax improve

In case you missed our splash right this moment: Liz Truss on Thursday night time rejected calls to extend the windfall tax on vitality firms to fund price of residing handouts for households, saying revenue shouldn’t be a “soiled phrase”.

Our foyer workforce experiences:

The International Secretary stated she was “completely” towards such taxes, arguing that such a coverage method could be taken by Labour.

The remarks are her clearest but on the topic and are available regardless of the Treasury devising an growth of the windfall tax as an choice for the subsequent prime minister.

As a brand new forecast predicted that annual vitality payments may soar to greater than £5,000 subsequent April, Ms Truss additionally stated she would elevate the ban on fracking.

09:47 AM

Cash round-up

Listed below are among the day’s high tales from the Telegraph Cash workforce:

09:21 AM

Flutter flies on upbeat US evaluation

Playing big Flutter Leisure is main FTSE 100 risers right this moment, popping 9pc greater after saying there had been “no discernable” slowdown from prospects.

The group – which operates PaddyPower and others – stated its US enterprise can also be performing higher than anticipated.

That has been welcomed by markets, as a result of America is seen as a key progress space.

Chief govt Peter Jackson stated:

We’re notably happy with momentum within the US the place we prolonged our management in on-line sports activities betting with FanDuel claiming a 51computer share of the market and primary place in 13 of 15 states, serving to contribute to optimistic earnings

09:05 AM

Rhine prone to fall beneath crucial level right this moment

The Rhine – Germany’s key waterway – is anticipated to turn out to be impassable at a key chokepoint right this moment as a heatwave devastates Europe.

Water ranges at Kaub, a very shallow level of the river, are prone to fall beneath 40cm right this moment based on Authorities knowledge. At that time, most of the barges that use the river will likely be unable to move.

As Bloomberg neatly sums it up:

The Rhine is used to ship every part from fuels to chemical compounds, paper merchandise to grains. The local weather disaster on the river couldn’t occur at a worse time, with Europe already within the grips of an vitality provide crunch within the wake of Russia’s battle in Ukraine. The dual crises have despatched prices hovering for companies, undermining efforts to tame inflation.

08:51 AM

GSK rises after pushback over Zantac claims

Pharma big GlaxoSmithKline is on the rise right this moment after saying it’s going to vigorously defend claims of a hyperlink between Zantac, a heartburn therapy it previously developed, and most cancers.

The FTSE 100 firm – which suffered its greatest share value drop since 1998 yesterday amid worries over authorized challenges – is up about 2.5pc.

It stated the litigation towards itself and a number of other others was “inconsistent with the scientific consensus”.

08:34 AM

Russian gas imports hit zero

One fascinating nugget from the ONS, which discovered general UK imports from Russia have been the bottom on report (again to 1997) – Britain appears to have gone utterly chilly turkey on Russian gas:

Imports of fuels, a traditionally vital commodity for commerce with Russia, reached £0.Zero billion in June 2022.

08:29 AM

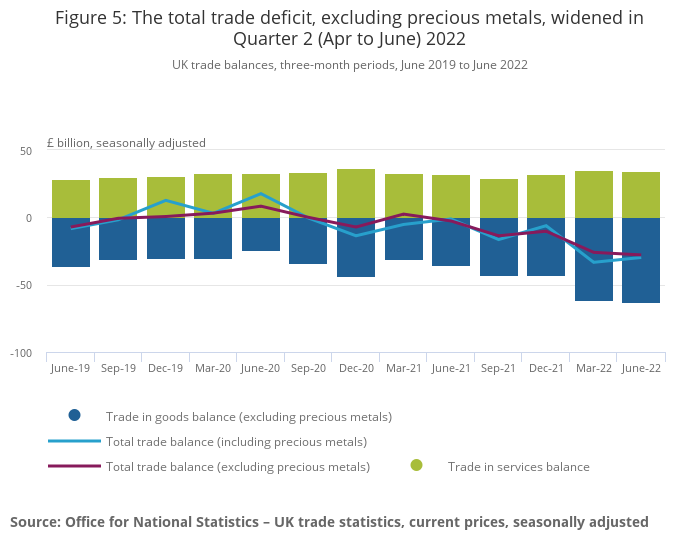

Commerce deficit widens to new report amid scramble for gas

The UK’s commerce deficit widened to a report £27.9bn throughout the second quarter amid a growth in demand for gas, based on the ONS.

It says:

Complete imports elevated by £14.Three billion to £206.6 billion, and whole exports elevated by £12.Three billion to £178.6 billion.

A part of this was as a result of inflation, statisticians stated: adjusted for value risest, the deficit narrowed by £2.4bn to £22.6bn.

Complete commerce fell 2.1pc, amid a decline in exports:

08:12 AM

FTSE 100 rises

It’s been a barely stronger-than-expected open for the FTSE 100 after these expectation-beating progress figures. The blue-chip index is up about 0.25computer in the mean time.

07:58 AM

Niesr: Financial system already in recession

The venerable Nationwide Institute of Financial and Social Analysis reckons the UK is already in a recession – standing out considerably by predicting one other fall in output this quarter.

As a reminder, two consecutive quarters of destructive progress is the standard definition of a recession.

Stephen Millard, its deputy director for macroeconomic modelling and forecasting, says:

It now seems just like the UK economic system entered a recession within the second quarter of this 12 months as GDP fell by 0.1 per cent, and we anticipate output to proceed falling over the subsequent three quarters.

07:52 AM

Response: Financial system holding up ‘higher than anticipated’

Right here’s among the response to this morning’s GDP numbers

Ruth Gregory from Capital Economics:

The higher-than-expected GDP figures for June means that the economic system is holding up a little bit higher than we had thought within the face of sky-high inflation. Even so, the GDP figures confirmed that the economic system contracted by 0.1pc q/q in Q2 and we have now not altered our view {that a} recession is on the way in which later this 12 months.

Thomas Pugh from auditor RSM :

The large rise in vitality payments in This fall is prone to tip the economic system right into a recession that may final roughly a 12 months and see a peak-to-trough fall in GDP of round 1pc-2pc. The massive image is that the economic system might be no bigger in 2025 than it was in 2019, earlier than the pandemic.

James Smith from the Decision Basis:

Whereas the contraction in June partly displays the timing of Platinum Jubilee financial institution holidays, the economic system has began a troublesome interval on a weak footing… The primary precedence for the brand new Prime Minister will likely be to supply additional focused help to low-and-middle revenue households who will likely be worst affected by the stagflation that already appears to be taking maintain.

07:41 AM

Extra on that recession…

The Financial institution of England has predicted that the economic system will fall right into a recession on the finish of 2022, lasting properly over a 12 months.

Right here’s how its prediction regarded – though it already seems to have been too downbeat concerning the second quarter.

Each Tory management candidates have pledged extra help for households struggling to pay their payments.

Liz Truss, the frontrunner to take over from Boris Johnson as Prime Minister, has rejected the concept a recession is inevitable. The overseas secretary has promised fast tax cuts to spice up incomes.

“We are able to change the end result and make it extra probably the economic system grows,” she stated final week.

Her rival Rishi Sunak has claimed Ms Truss’s “unfunded” tax cuts would pour “gas on the fireplace” of inflation, which is anticipated to hit 13.3pc in October, when the vitality value cap is anticipated to surge.

07:38 AM

Tourism and inns profit from fall in circumstances

The ONS stated vacationer sights and inns benefitted after Covid-19 journey restrictions have been lifted on the finish of March.

Days out elevated, serving to to spice up the leisure trade, whereas the Queen’s Platinum Jubilee celebrations drove a surge in gross sales at cell meals stands and takeaway meals outlets, at the same time as the additional financial institution vacation in June dragged down month-to-month output.

Most analysts anticipate the economic system to bounce again over the summer time (July to September), earlier than a surge in vitality payments this October drags the economic system again into decline.

07:36 AM

Wind-down of pandemic-era schemes was greatest drag on companies

Britain could have been returning to ‘regular’ for a lot of the second quarter, however lower each methods for progress due to the winding up of the Authorities’s huge pandemic-era well being schemes.

Throughout companies, the ONS says “the biggest destructive contribution from human well being and social work actions, reflecting a discount in coronavirus (COVID-19) actions”.

General:

There was a 5.4pc fall in human well being and social work actions, reflecting a big discount in coronavirus actions, corresponding to NHS Take a look at and Hint, COVID-19 vaccination programme and lateral move orders over the second quarter.

Right here’s how that appears within the context of service contributions to progress extra broadly:

07:32 AM

British progress second-worst in G7

Right here’s that 0.1pc decline within the context of different G7 international locations. As you may see, the UK has discovered itself close to the underside of the pack, with solely the US (which has entered a technical recession) performing worse.

07:28 AM

Financial system nonetheless greater than earlier than pandemic

Regardless of the general quarterly fall, and the 0.6pc June decline, the UK economic system remains to be 0.9pc greater than earlier than the pandemic (i.e. February 2020) on a month-to-month foundation, per the ONS:

07:23 AM

Onerous to cost in Jubilee influence

The Queen’s Platinum Jubilee celebration actually had an influence on progress in June, says the ONS, though on first learn it appears statisticians struggled to place an actual quantity on it.

They are saying:

The Platinum Jubilee, and the transfer of the Could financial institution vacation, led to a further working day in Could 2022 and two fewer working days in June 2022. This ought to be thought of when deciphering the seasonally adjusted actions involving Could and June 2022.

One space the place the festivities seem to have precipitated a transparent enhance is consuming out: estimates from reserving service OpenTable present a 23computer improve in seated restaurant diners through the week containing the Jubilee financial institution holidays.

Within the broad although, it was fairly muted. The ONS says “there was little influence on the quarterly estimates” from the celebration.

07:16 AM

‘Too early’ to name recession

Yael Selfin, chief economist at KPMG UK, says it’s “too early” to name a recession. She provides:

Momentary components corresponding to an additional financial institution vacation and the phasing out of the Take a look at & Hint scheme have been behind the autumn in GDP in Q2. Whereas we see growing indicators of underlying weak point within the economic system, we anticipate a extra extreme downturn to happen solely from in direction of the top of this 12 months.

07:15 AM

Zahawi: We are able to pull via

Right here’s Chancellor Nadhim Zahawi’s response to these figures:

Our economic system confirmed unimaginable resilience following the pandemic and I’m assured we will pull via these world challenges once more.

I do know that occasions are robust and other people will likely be involved about rising costs and slowing progress, and that’s why I’m decided to work with the Financial institution of England to get inflation below management and develop the economic system.

07:14 AM

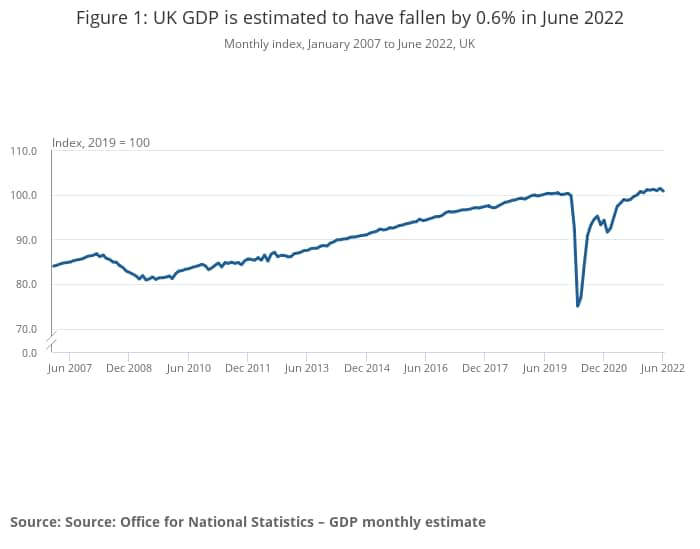

Snap take: First quarterly contraction since early 2021

Britain’s economic system shrank by 0.1pc between April and June amid the worst inflationary disaster in a long time.

GDP fell on a quarterly foundation for the primary time because the begin of final 12 months, amid a 0.6pc output fall in June alone.

That marked the worst month-to-month drop since January 2021, when the nation was in a stringent winter lockdown.

The economic system is anticipated to develop through the present quarter, earlier than slumping right into a recession later this 12 months as rocketing costs crush exercise and demand.

Darren Morgan, the ONS’s director of financial statistics, stated:

Well being was the most important cause the economic system contracted as each the take a look at and hint and vaccine packages have been wound down, whereas many retailers additionally had a tricky quarter. These have been partially offset by progress in inns, bars, hairdressers and out of doors occasions.

07:05 AM

Decline throughout all main sectors

All sectors suffered a decline in output throughout June, though manufacturing got here out of the quarter trying unscathed regardless of hovering costs.

07:03 AM

Slowdown much less sharp than feared

Each right this moment’s headline numbers got here in softer than economists had feared:

07:02 AM

Breaking: Financial system suffers quarterly contraction

Simply in: The UK economic system shrank by the slimmest of margins through the second quarter, with GDP falling by 0.1pc after a 0.6pc decline in June.

06:57 AM

Agenda: Britain braced for contraction

Good morning. It’s all about progress this morning, as we get June figures for GDP that may full numbers for the second quarter.

Nationwide output is anticipated to have taken a 1.2pc knock in June, down partially to the Platinum Jubilee celebrations. Throughout the quarter, that’s anticipated to lead to a 0.2pc fall.

Elsewhere, the FTSE 100 is on track for a flat day, after falling yesterday regardless of wider optimism about calming inflation.

5 issues to begin your day

1) British EDF customers pay twice as much as French for energy Macron’s value cap on state-owned provider shields households from hovering prices

2) Hong Kong suffers record fall in population as people flee zero-Covid curbs The town misplaced 113,200 residents within the 12 months to June

3) Breaking up HSBC would unlock up to £29bn payday, says Chinese shareholder Insurer accuses lender of ‘exaggerating’ problem of spinning off its Asian enterprise

4) Heathrow sale revives hopes of a third runway under new Prime Minister However whoever enters Quantity 10 nonetheless faces environmental hurdles and a sector in flux

5) Mark Zuckerberg branded ‘creepy’ by Facebook’s own chatbot Social media firm ‘exploits individuals for cash’, synthetic intelligence program warns

What occurred in a single day

Asian markets largely fell on Friday, winding again among the earlier day’s rally, as merchants come to phrases with the chance that central banks will proceed to boost rates of interest to battle runaway inflation.

Asia struggled to take care of momentum, with Hong Kong, Shanghai, Sydney, Seoul, Singapore, Manila, Jakarta and Wellington all barely decrease.

Tokyo, nevertheless, jumped greater than 2pc and buyers there returned from a one-day break to play catch-up with Thursday’s bounce. Taipei additionally rose.

Developing right this moment

-

Company: 888 Holdings, Flutter Leisure, TBC Financial institution Group (interims)

-

Economics: GDP (UK), industrial manufacturing (UK, EU), manufacturing manufacturing (UK), Michigan client sentiment index (US)

Source link