[ad_1]

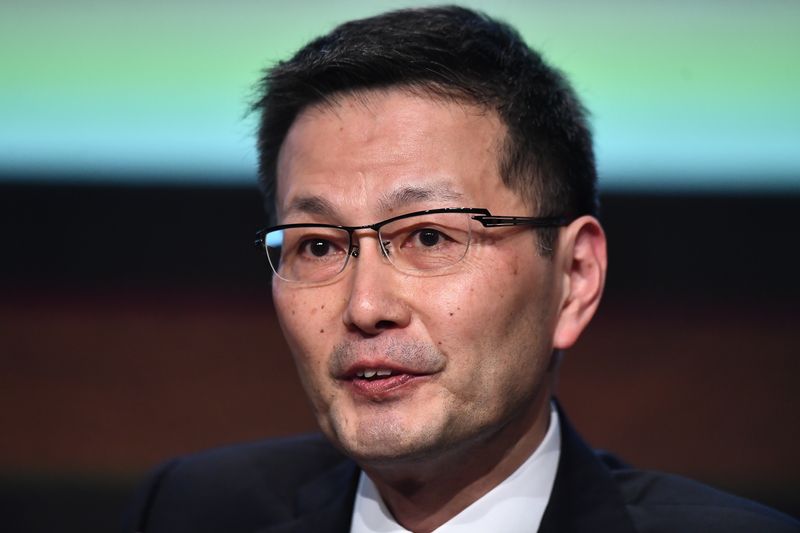

© Reuters. FILE PHOTO: Deputy Governor on the Financial institution of Japan, Masazumi Wakatabe, speaks at a European Monetary Discussion board occasion in Dublin, Eire February 13, 2019. REUTERS/Clodagh Kilcoyne/File Picture

TOKYO (Reuters) – At the same time as cost-push components enhance inflation, world central banks have to be vigilant to the chance of “Japanification”, through which their economies face extended low inflation and stagnation, mentioned Financial institution of Japan (BOJ) Deputy Governor Masazumi Wakatabe.

Varied structural components might weigh on the impartial fee, or the speed at which financial coverage is neither stimulating nor proscribing development, throughout the globe, he mentioned.

Which means the principle problem for central banks can be to successfully push down actual rates of interest to reflate their economies, Wakatabe advised an educational convention, in accordance with a textual content of his speech launched on Saturday.

“When historical past, the gentle inflation regime has not ended and the potential hazard of extended financial stagnation, or ‘Japanification’, has not been dispelled,” he mentioned.

“What Japan’s lengthy expertise with deflation exhibits is that it is fairly arduous to eradicate fears of deflation,” mentioned Wakatabe, who is called a vocal advocate of aggressive financial easing.

BOJ Governor Haruhiko Kuroda deployed a large asset-buying programme in 2013 to drag Japan out of practically 20 years of deflation, which was blamed for prolonging its financial stagnation as a result of companies and households hoarded money as an alternative of spending it.

After heavy cash printing failed to fireplace up inflation to a 2% goal, the BOJ shifted in 2016 to a coverage focusing on rates of interest. It continues to keep up ultra-low charges, at the same time as rising uncooked materials prices push inflation above the goal.

Wakatabe, whose five-year time period as deputy governor ends in March, has persistently pressured the necessity to hold financial coverage ultra-loose to place a sustained finish to deflation.

Source link