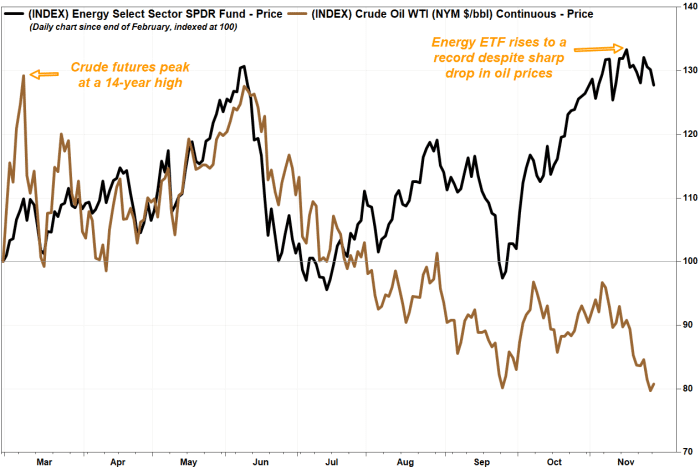

One thing seems mistaken with the chart evaluating power shares with crude-oil costs, as what was once a near-100% correlation has flipped to unfavorable since oil costs peaked earlier this 12 months.

Brian Reynolds, chief market strategist at Reynolds Technique LLC, stated that unfavorable correlation is a warning for traders in oil shares, who look like shopping for on the assumption inflation retains rising with out regard for the efficiency of the underlying commodity.

“Thus, we consider oil shares are particularly weak to an extra decline in oil costs,” Reynolds wrote in a observe to shoppers.

The correlation coefficient between steady crude-oil futures

CL00,

+0.18%

and the SPDR Power Choose Sector exchange-traded fund

XLE,

-2.74%,

from when crude futures closed at a 23-year low of $11.57 on April 21, 2020, to when the power ETF (XLE) closed at a then-eight-year excessive of $92.28 on June 8, 2022, was 0.96, in line with a MarketWatch evaluation of FactSet knowledge.

A correlation of 1.00 would imply the 2 had been transferring precisely in tandem.

However for the reason that XLE’s June peak, the correlation has been unfavorable 0.27, that means as a rule, crude futures and the XLE have moved in several instructions. On Monday, the XLE was down 2.1% in afternoon buying and selling whereas crude futures rallied 1.5%.

FactSet, MarketWatch

The XLE, which reached a contemporary eight-year excessive of $94.08 on Nov. 15, has gained 16% since crude futures peaked on March 8, whereas crude futures have tumbled 37.4% and the S&P 500 index

SPX,

-1.54%

has misplaced 4.9%.

When oil costs plummeted sharply in 2014 amid a provide glut, the correlation between crude futures and the XLE within the eight months after crude peaked on in June 2014 was 0.94.

Amongst some XLE parts, the correlation crude futures and Chevron Corp.’s inventory

CVX,

-2.91%,

from the April 2020 crude trough to the June 2022 peak in Chevron, was 0.91, whereas the correlation since then has been unfavorable 0.29. For Exxon Mobil Corp.’s inventory

XOM,

-3.00%,

the correlation with crude flipped to 0.94 to unfavorable 0.37.

Some draw back chart ranges to look at embody the $85 space, the place prior resistance on the August highs and 50-day transferring common (DMA), a intently watched short-term development tracker, presently converge.

FactSet, MarketWatch

Under that, the 200-DMA, which many see has a dividing line between longer-term uptrends and downtrends, presently extends to about $79. (Remember that not solely are crude-oil futures under each the 50-DMA and the 200-DMA, the 50-DMA crossed under the 200-DMA — a bearish “demise cross” — in early September.)

Additionally, an uptrend line beginning in October 2020, and roughly connecting lows in August, and October 2021 and July and September 2022, presently extends to about $72.25, whereas the potential assist outlined by the July and September 2022 lows is within the $65-to-$68 vary.