[ad_1]

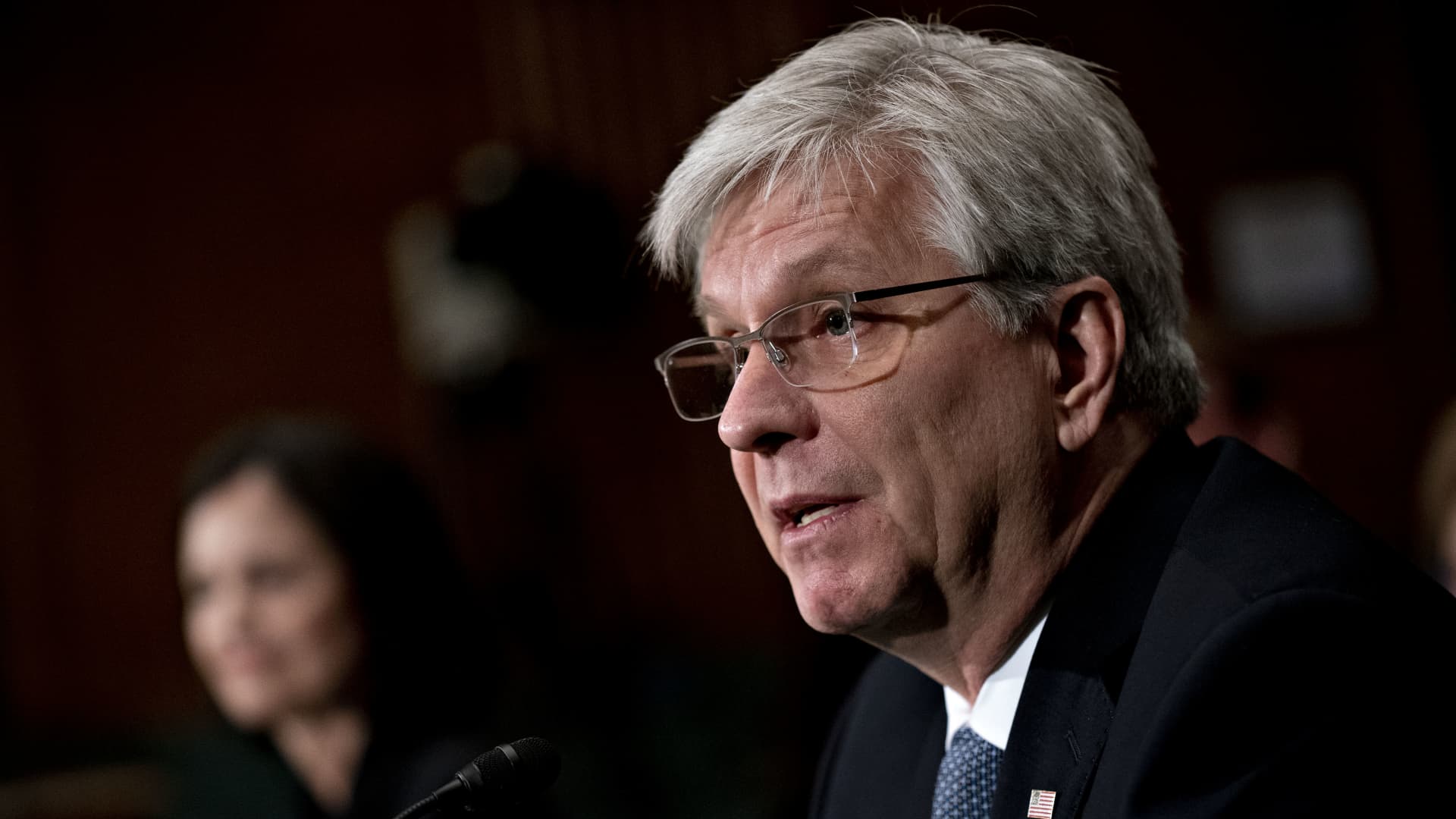

Federal Reserve Governor Christopher Waller instructed CNBC on Friday that the central financial institution could must enact a number of 50 foundation level rate of interest hikes this 12 months to tame inflation.

Although he voted this week for simply a 25 basis point move because of uncertainty from the Russian invasion of Ukraine, Waller stated he thinks the Fed could have to be extra aggressive quickly.

“I actually favor front-loading our fee hikes, that we have to do extra withdrawal of lodging now if we need to have an effect on inflation later this 12 months and subsequent 12 months,” he instructed CNBC’s Steve Liesman throughout a “Squawk Box” interview. “So in that sense, the way in which to front-load it’s to tug some fee hikes ahead, which might indicate 50 foundation factors at one or a number of conferences within the close to future.”

Along with the speed hikes, Waller stated he thinks the Fed wants to start out decreasing its bond holdings quickly.

The central financial institution steadiness sheet has ballooned to just over $9 trillion, and officers are getting ready the method to start out rolling off a few of their holdings. Waller stated that course of ought to begin “within the subsequent assembly or two.”

“We’re in a special place than we have been earlier than,” he stated. “We now have a a lot larger steadiness sheet, the financial system’s in a a lot completely different place. Inflation is raging. So, we’re able the place we may truly draw down a considerable amount of liquidity out of the system with out actually doing a lot harm.”

Waller’s feedback got here lower than two hours after one in all his colleagues, St. Louis Fed President James Bullard, said the Fed should raise rates in complete at the very least 300 foundation factors this 12 months. A foundation level is 0.01 share level.

Bullard was the one policymaker this week to vote towards the quarter-point improve, saying the Fed ought to have passed by half a degree as a part of a deliberate coverage geared toward curbing inflation working at 40-year highs.

Earlier than the assembly, Waller additionally had been pushing for a 50 foundation level transfer, however stated he had a change of coronary heart for now.

“The information’s mainly screaming at us to go 50, however the geopolitical occasions have been telling you to go ahead with warning,” he stated. “So these two elements mixed pushed me off of advocating for a 50 foundation level hike and supporting the 25-point hike that we enacted.”

The complete Federal Open Market Committee additionally pointed to fee hikes that may push the benchmark fed funds fee, which banks cost one another for in a single day lending, to 1.75% by 12 months’s finish.

Waller stated he believes the Fed ought to shoot somewhat larger than that. He didn’t specify by how a lot however stated he thinks the “impartial fee” that’s neither stimulative nor restrictive is between 2% and a pair of.25%, and the Fed ought to “attempt to be above that by the tip of the 12 months.”

The speed hike accredited this week was the Fed’s first in additional than three years.

Source link