[ad_1]

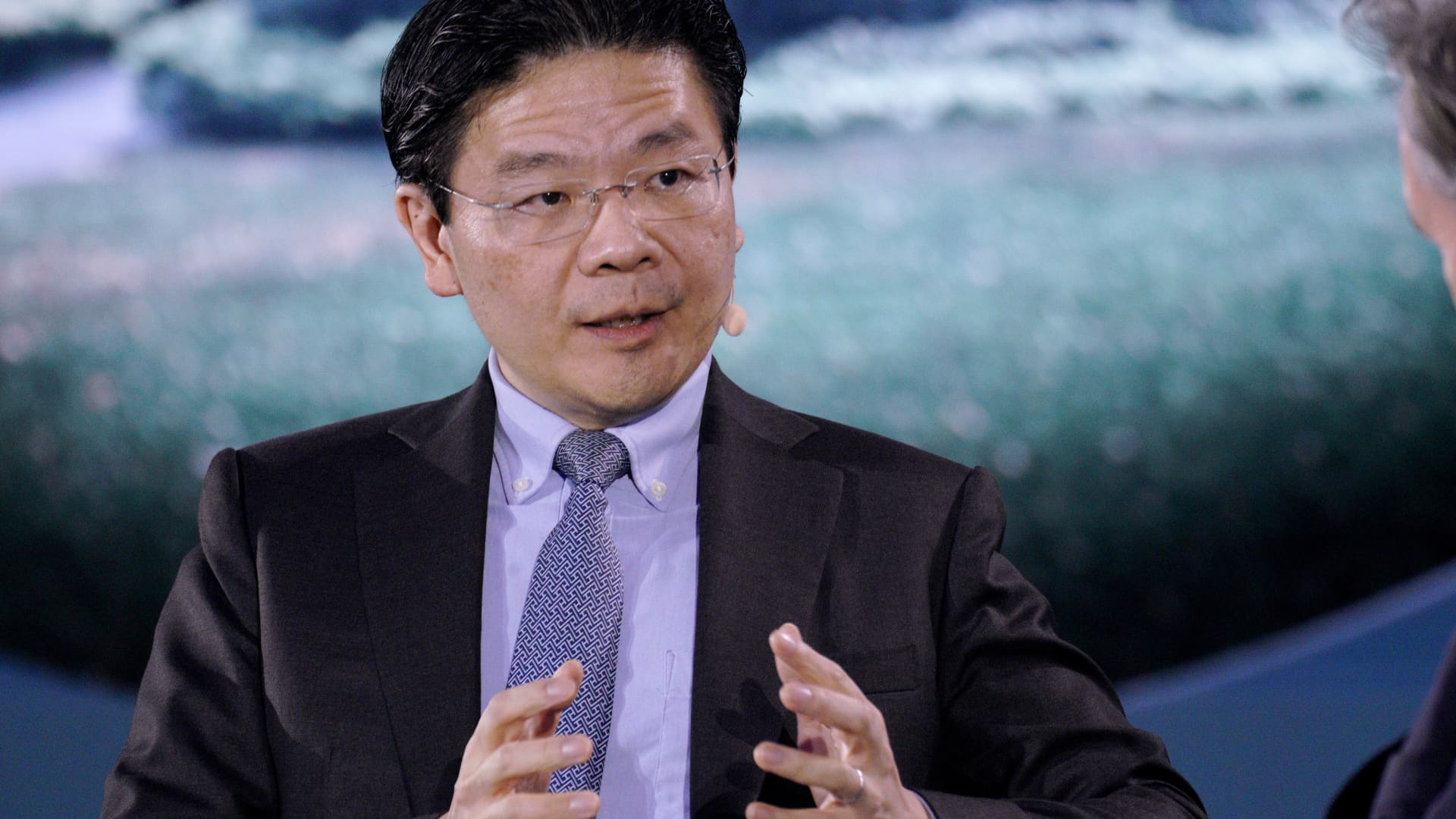

Lawrence Wong, Singapore’s finance minister, speaks throughout the Bloomberg New Financial system Discussion board in Singapore, on Thursday, Nov. 17, 2022.

Bryan van der Beek | Bloomberg | Getty Photographs

Temasek’s funding lack of $275 million within the collapse of cryptocurrency change FTX was “disappointing” and damaging for Singapore, mentioned Deputy Prime Minister and Finance Minister Lawrence Wong.

Talking in Parliament on Wednesday, Wong mentioned that the losses Singapore’s sovereign wealth fund suffered had been “being taken critically.”

However the funding losses do not imply the governance system isn’t working, he mentioned. “Relatively, it’s the nature of funding and risk-taking.”

Temasek introduced in mid-November that it’s going to be writing down the worth of its funding in FTX to zero, “regardless of the end result of FTX’s chapter safety submitting.” Temasek additionally mentioned that they at the moment don’t have any direct publicity in cryptocurrencies.

What occurred with FTX subsequently has not solely triggered monetary loss to Temasek, but additionally reputational injury.

Lawrence Wong

Deputy Prime Minister, Singapore

FTX has greater than 100,000 collectors in addition to liabilities within the vary of $10 billion to $50 billion, in keeping with a chapter submitting.

“What occurred with FTX subsequently has not solely triggered monetary loss to Temasek, but additionally reputational injury,” Wong mentioned.

“Temasek acknowledges this and has issued a complete assertion to clarify its due diligence course of and the circumstances resulting in its funding in FTX,” he mentioned, including that an inner overview is being performed to review what went incorrect with the FTX deal and learn how to enhance the method.

He mentioned the federal government doesn’t prescribe tips on the allocation of particular property or asset lessons, whether or not for cryptocurrencies or different property.

In the end, the federal government holds the boards and administration groups answerable for formulating funding methods in accordance with the federal government’s total danger tolerance, he mentioned.

“What’s necessary is that our funding entities take classes from every failure and success, and proceed to take well-judged dangers to be able to obtain good total returns in the long run,” Wong mentioned in response to Members of Parliament’s questions.

“On this approach, we are able to proceed so as to add to our nationwide reserves and supply a steady earnings stream to fund authorities applications for a very long time to return.”

He identified that regardless of the writing off of the FTX funding, Temasek’s early-stage portfolio, as of March, generated an inner charge of return within the mid-teens during the last decade — higher than the trade common.

The FTX loss may even not affect the online funding returns of Singapore’s reserves, that are “tied to the general anticipated long run returns of our funding entities and to not particular person investments.”

The minister mentioned that going ahead, the Financial Authority of Singapore — the nation’s monetary regulator and central financial institution — plans to introduce some primary investor safety measures for digital cost token service suppliers that are licensed in Singapore.

After receiving trade and public suggestions, MAS will finalize the proposals and implement applicable regulatory measures.

However he cautioned that even with these measures, the financial authority will be unable to forestall crypto service suppliers from failing.

“Those that commerce cryptocurrencies should be ready to lose all their worth. No quantity of regulation can take away this danger,” he warned.

Source link