[ad_1]

Germany should strike a cope with Putin to keep away from an vitality disaster this winter and Ukraine ought to surrender its declare to Crimea, Gerhard Schröder has stated.

The previous German Chancellor stated his nation may avert a fuel crunch by restarting work on the Nord Stream 2 pipeline from Russia.

The $11bn mission, which might double Russian fuel provides to Germany, was accomplished final yr however the approval course of was halted on the outbreak of the conflict in February.

Mr Schröder, former chair of Rosneft and head of the shareholder committee at Nord Stream, additionally stated Ukraine ought to abandon its declare to Crimea and negotiate with Putin.

He advised Stern journal it might be a “large mistake” to dismiss doable concessions by Ukraine as a “dictated peace”.

He stated issues might be resolved by means of a compromise for the Donbas area primarily based on a Swiss canton mannequin, in addition to “armed neutrality” for Ukraine as an alternative choice to Nato membership.

04:50 PM

Former SFO prosecutor ‘unfairly’ fired over row with US official calls for job again

A former high prosecutor on the Critical Fraud Workplace who was fired over claims he known as an American counterpart a “c—” is demanding his job again after his dismissal was dominated unfair. Matt Oliver stories:

Tom Martin, who beforehand led advanced corruption circumstances, was sacked by the British company in 2018 following claims he insulted a US official whereas socialising in a pub.

His declare of unfair dismissal was upheld by an employment tribunal and the SFO’s try and overturn the ruling was defeated final month.

Nonetheless, in a break from the overwhelming majority of such circumstances, Mr Martin is now in search of reinstatement reasonably than compensation alone.

In a press release, he advised the Each day Telegraph: “I’m delighted with the result of the enchantment, which totally upheld that my dismissal was unfair.

“The SFO’s selections in dismissing me on a foundation that has confirmed to be each factually and legally mistaken and a breach of contract have left me with no alternative however to carry these proceedings to clear my identify and shield my profession.”

04:29 PM

New York Occasions to push for subscription bundles

The New York Occasions plans to extra aggressively promote bundles of its subscription merchandise to drive income and offset stress from advertisers who’re chopping spending in a weakening financial system.

On an earnings name in the present day, chiefMeredith Kopit Levien stated the paper will “lean extra closely” into promoting readers on multiple subscription, together with information, video games, cooking, Wirecutter and the Athletic, a sports activities web site the Occasions purchased earlier this yr.

The group posted its highest variety of new begins to its “all digital entry bundle” within the second quarter. Levien stated bundle subscribers pay extra over time and are much less prone to cancel.

The bundling technique can also be aimed toward serving to the Occasions continue to grow even when the information cycle slows. The publication added 180,000 digital-only subscribers within the second quarter, reaching a complete of 9.2m subscribers. It expressed confidence in reaching its aim of 15m subscribers by 2027.

04:09 PM

Handing over

That is all from me in the present day – thanks for following! Handing over now to Giulia Bottaro.

04:08 PM

Shell fingers employees 8pc bonus after file earnings

Shell will hand employees a one-off 8pc bonus after the vitality large reported file earnings after cashing in on the current surge in costs.

Most employees on the FTSE 100 firm, which employs round 82,000 individuals worldwide, might be eligible for the pay enhance.

Solely these at govt vp stage or larger might be excluded from the taxable payout.

Shell stated the award displays the corporate’s present monetary success however has no hyperlink to the rising price of dwelling challenges.

A Shell spokesman stated:

In recognition of the contribution our individuals have made to Shell’s sturdy operational efficiency in opposition to a current difficult backdrop, our govt committee has determined to make a Particular Recognition Award of 8pc of wage to all eligible employees internationally.

The award permits these workers to share in our present operational and monetary success – it isn’t a response to inflation or cost-of-living challenges.

03:49 PM

Ukraine brushes of Schröder’s conflict feedback

Ukraine has stated that any negotiated peace settlement with Moscow could be contingent on a ceasefire and the withdrawal of Russian troops because it disregarded feedback by Gerhard Schröder.

The previous German Chancellor, who’s a pal of Putin, stated he met the Kremlin chief in Moscow final week, that Russia wished a “negotiated answer” to the conflict and that there was even the potential of slowly reaching a cease-fire.

In a response this afternoon, Ukrainian presidential adviser Mykhailo Podolyak described Schröderderisively as a “voice of the Russian royal court docket”.

He wrote: “If Moscow desires dialogue, the ball is in its court docket. First — a cease-fire and withdrawal of troops, then — constructive (dialogue).”

03:23 PM

Treasury backs £3bn export finance package deal for Ukraine

Chancellor Nadhim Zahawi is backing a brand new £3bn export finance aimed toward bolstering Ukraine’s army defence in opposition to Russia and funding its reconstruction.

The Chancellor has advised worldwide commerce secretary Anne-Marie Trevelyan that he helps a request for credit score amenities offered by UK Export Finance (UKEF).

In a letter seen by Sky Information, Mr Zahawi stated he thought of it “important that we proceed supporting the federal government of Ukraine in any method we are able to and demonstrating our religion in the way forward for Ukraine”.

The UKEF credit score amenities comprise as much as £2.3bn for the financing of army contracts recognized by the Ukrainian authorities, with the remaining £700m earmarked for reconstruction tasks.

02:58 PM

British Airways poised to droop sale of long-haul flights from Heathrow

British Airways is poised to pause gross sales of long-haul flights to locations similar to New York because the airline battles disruption at Heathrow, writes Matt Oliver

The provider has already suspended ticket gross sales for short-haul flights from the nation’s largest airport for at the least every week in response to a cap on every day passenger numbers.

However a spokesman confirmed that BA can’t rule out disruption to long-haul routes out of Heathrow both whereas the cap stays in place.

It may push costs larger and imply travellers making an attempt to ebook last-minute journeys to further-afield locations similar to New York, Singapore or Dubai could also be unable to search out seats.

And price range rival Ryanair on Wednesday prompt it was well-positioned to capitalise on the turmoil.

02:43 PM

Wall Road opens larger forward of providers information

Wall Road’s principal indices opened larger after two days of declines as targeted shifted to providers exercise information due later in the present day.

The S&P 500 and Dow Jones each opened 0.4pc larger, whereas the tech-heavy Nasdaq gained 0.7pc.

02:21 PM

Opec to approve tiny oil output rise in blow to Biden

Opec is about to lift oil output by a miniscule 100,000 barrels per day in what analysts described as an insult to Joe Biden.

The US President made a visit to Saudi Arabia final month to influence the Opec chief to pump extra to assist the US and international financial system.

The rise, equal to 86 seconds of world oil demand, comes after weeks of hypothesis that the journey – in addition to Washington’s clearance of missile defence system gross sales to Riyadh and the UAE – would carry in additional oil.

An Opec doc seen by Reuters confirmed the group was set to lift output by 100,000 bpd from September and two sources stated it has been successfully rubber-stamped at a gathering.

01:56 PM

Firefighters sort out blaze at Russian retailer’s warehouse

A hearth broke out at a warehouse exterior Moscow owned by Russian e-commerce large Ozon.

Emergency providers within the nation stated greater than 80 individuals had been working to sort out the blaze and two helicopters had been deployed.

Russia’s RIA information company cited emergency providers as saying that 11 individuals have been reported injured within the fireplace, which the emergencies ministry stated in a press release had unfold to an space of 35,000 sq. metres.

Footage taken by a Reuters photographer on the scene confirmed a big plume of darkish smoke billowing from the roof of the warehouse.

01:34 PM

Particles from Elon Musk’s SpaceX rocket rains down on farm

Rocket particles believed to be from Elon Musk’s SpaceX has rained down on a sheep farm in rural Australia, piercing the panorama with chunks of jagged steel.

Matthew Subject stories:

Lumps of rocket had been discovered embedded in farmland by native farmer Mick Miners of Jindabyne, New South Wales.

Locals reported listening to a loud bang throughout the Snowy Mountains space of the area, earlier than the items of wreckage had been discovered, Australia’s ABC reported.

Australian area specialists stated they believed the rocket elements got here from a discarded crew capsule utilized by SpaceX’s 2020 crewed Dragon mission to the Worldwide Area Station.

The capsule was jettisoned into area after finishing its mission and was imagined to finally splash down into the ocean.

Brad Tucker, an area knowledgeable at Australian Nationwide College, advised native radio station 2GB: “SpaceX has this capsule that takes people into area however there’s a backside half… so when the astronauts come again, they depart the underside half in area earlier than the capsule lands.

12:35 PM

Bottlenecks dent German automobile gross sales

German automobile gross sales fell once more in July because the business battled persistent bottlenecks for key elements.

Just below 206,000 vehicles had been registered in Germany in July, 12.9pc lower than in the identical month final yr, in line with the federal transport authority.

New automobile gross sales had already fallen by 18.1pc in June and 10.2pc in Could.

Automotive producers have needed to cope with provide points for months, with shortages of key elements resulting in intermittent manufacturing stops and a droop in gross sales.

Specifically, a scarcity of semiconductors, used within the autos’ digital programs, has slowed the business down.

12:12 PM

Parliament shuts down TikTok account on safety issues

Parliament has shut down its TikTok account lower than every week after it was arrange.

The transfer comes after MPs sanctioned by China raised issues about information safety, Politico stories.

Nus Ghani, Tom Tugendhat and Ian Duncan Smith all wrote to the Speaker final week. The account has now been locked and its content material deleted.

12:00 PM

US futures rise as Pelosi completes Taiwan go to

US futures have pushed larger as a few of the investor anxiousness over US-China tensions eased.

US Home Speaker Nancy Pelosi accomplished a go to to Taiwan that has provoked an offended response from China, with markets calmer in contrast with the wave of tension that washed throughout property forward of her arrival. The yen and a greenback gauge had been little modified.

Futures monitoring the S&P 500, Dow Jones and Nasdaq all gained 0.4pc.

11:40 AM

Turkish inflation nears 80laptop

Turkish inflation soared to almost 80laptop final month, with skyrocketing meals, housing and vitality costs hitting shoppers exhausting.

The Turkish Statistical Institute stated client costs rose by 79.6pc from a yr earlier, up about one proportion level from June.

Economists have blamed the massive rise in inflation on President Recep Tayyip Erdogan’s unorthodox perception that top borrowing prices result in inflation regardless of established financial concept.

Additionally they say inflation might be even larger than official figures.

Turkey’s central financial institution has slashed rates of interest by 5 proportion factors since September to 14laptop, sending the lira into sharp decline.

That contrasts with efforts by central banks around the globe to lift rates of interest to sort out worth rises.

11:22 AM

BMW warns on chip shortages and Ukraine disruption

BMW has warned that automobile deliveries might be decrease this yr than final as a scarcity of microchips, Covid lockdowns in China and disruption from the conflict in Ukraine hammer the business.

Louis Ashworth stories:

The German carmaker reduce its supply outlook and stated enterprise circumstances are prone to “stay tough” in the course of the second half of the yr, blaming the conflict in Ukraine and provide chain disruptions.

Oliver Zipse, its chief govt, stated: “We see an growing financial headwind arising along with the continued provide shortages.”

BMW’s web revenue fell to €3bn in the course of the second quarter amid provide bottlenecks and delays brought on by lockdowns in China. It shipped simply over 563,000 items between April and June, down 19.8pc from the identical interval in 2021.

“The continuing provide bottlenecks, significantly for semiconductors, the conflict in Ukraine and interruptions in provide chains have led to a decline in deliveries within the Automotive section within the first half of the yr,” stated BMW.

The corporate stated a few of the shortfall in gross sales was being offset by worth will increase. With manufacturing restricted, BMW has targeted its assets on higher-end autos, which have higher revenue margins. The Munich-based firm stated this “high-quality product combine” was serving to to stem falling earnings.

10:58 AM

Gasoline costs swing as merchants search readability over Russian provides

Pure fuel costs fluctuated after two days of beneficial properties as Russian provides stay low however steady, with merchants on the lookout for extra readability over Moscow’s subsequent transfer.

Benchmark European costs swung between beneficial properties and losses, although they’re nonetheless buying and selling close to their highest because the early days of the conflict in March.

Costs surged after Russia curbed flows by means of the important thing Nord Stream pipeline to round 20laptop of transaction.

Moscow has blamed technical points, however German Chancellor Olaf Scholz in the present day reiterated that there have been no delays on Germany’s facet and laid the blame with the Kremlin.

10:42 AM

Pound edges larger forward of BoE choice

Sterling edged larger in opposition to a broadly weaker greenback this morning as buyers stay targeted on tomorrow’s Financial institution of England assembly.

Cash markets are presently pricing in a larger than 90laptop probability of a giant 50 basis-point price hike because the Financial institution makes an attempt to chill inflation from a four-decade excessive of 9.4pc.

However analysts stated the pound was largely being pushed by danger sentiment and exterior components forward of the coverage assembly.

The pound rose 0.1pc in opposition to the greenback to $1.21735. In opposition to the euro it slipped 0.1pc to 83.65p.

10:23 AM

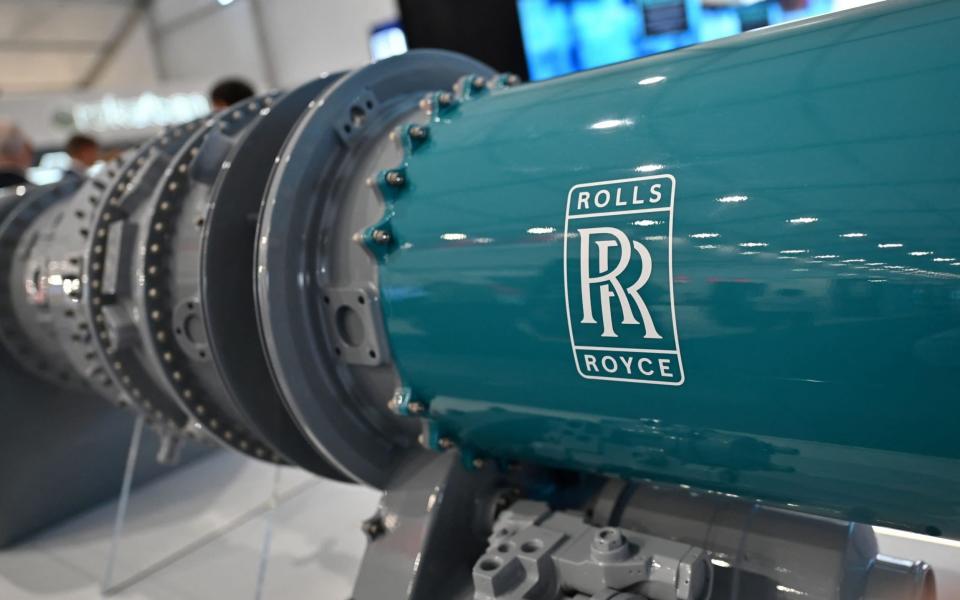

Rolls-Royce will get go-ahead for £1.5bn ITP Aero sale

In additional deal information this morning, Rolls-Royce has been given the inexperienced gentle by the Spanish authorities to promote its ITP Aero enterprise for €1.8bn (£1.5bn).

The engineering large will hand over the Spanish enterprise – which builds plane engines and generators – to a consortium of buyers led by personal fairness agency Bain Capital.

The sale completes the corporate’s plan to lift at the least £2bn and assist rebuild its stability sheet, Rolls-Royce stated.

The consortium buying ITP Aero, which has its headquarters within the Basque area, additionally consists of Sapa and JB Capital.

Final yr, Rolls-Royce chief govt Warren East known as the sale a “vital milestone” in its cash-boosting disposal programme.

10:10 AM

Avast surges on £6bn takeover approval

Shares in Avast have soared to a file excessive after the competitors watchdog waved by means of its £6bn takeover by Norton LifeLock.

The cybersecurity agency surged 42laptop to the highest of the FTSE 100. That is its largest bounce ever.

09:58 AM

Employees to endure file wage squeeze as Britain plunges into recession

Britain is plunging into recession because the surging price of dwelling inflicts a long-term pay reduce on struggling employees and wipes out the financial savings of greater than two million households, considered one of Britain’s main forecasters has warned.

Tim Wallace has extra:

Hovering payments will power tens of millions of individuals to make use of their financial savings or flip to borrowing to pay for the fundamentals as inflation climbs to 11laptop, in line with the Nationwide Institute for Financial and Social Analysis (Niesr).

Round 5.3m households may have no financial savings in any respect by 2024, one in each 5, and twice the present stage. One other 1.7m might be left with lower than two months of earnings within the financial institution, making them weak to any monetary surprises.

For 1.2m households, meals and vitality payments alone will exceed their disposable incomes, even earlier than another spending.

Actual private disposable incomes are predicted to fall by 2.5pc this yr owing to a mix of upper prices and Rishi Sunak’s tax raids, marking the sharpest annual drop since data started in 1948.

09:27 AM

Hiscox to offer insurance coverage for Ukraine grain hall

Hiscox has revealed it is a part of a deliberate insurance coverage consortium offering cowl for ships taking grain out of Ukraine.

Commerce physique the Lloyd’s Market Affiliation final month stated a consortium might be fashioned to offer cowl for grain shipments.

Aki Hussain, Hiscox chief govt, stated the consortium hadn’t but been finalised however stated the corporate had dedicated its assist.

It got here because the Lloyd’s of London insurer plunged to a pre-tax lack of $107m (£88m) within the first half on account of a steep decline within the worth of its funding portfolio.

The corporate stated losses from Ukraine and Russia had been $48m web of reinsurance – a slight enhance from a $40m estimate made in Could.

09:15 AM

Tinder boss quits

The chief govt of Tinder has give up a fortnight after launching a “belief and security” drive to carry extra girls onto the relationship app, writes Gareth Corfield.

Renate Nyborg was the corporate’s fifth boss since 2012. A Could 2022 profile of Nyborg described her as a “steady, drama-free chief”. She was appointed to the highest seat final September.

In a BBC interview in late July Ms Nyborg, 36, who met her husband on Tinder, stated she was launching a drive to enhance girls’s security on the app by offering higher abuse reporting instruments.

“As we speak we’re asserting the departure of Tinder CEO Renate Nyborg, and I’ve made some modifications to the administration group and construction that I’m assured will assist ship Tinder’s full potential,” Match Group chief govt Bernard Kim stated in a letter to shareholders.

09:03 AM

Taylor Wimpey beneficial properties on ‘sturdy’ housing demand

Taylor Wimpey is among the FTSE’s high risers this morning after it hailed “sturdy” demand for housing regardless of hovering construct price inflation and rising rates of interest.

The housebuilder posted a 16.3pc rise in pre-tax earnings to £334.5m for the primary half of the yr as completions got here in barely forward of expectations.

Because of this, it raised its expectations for full-year earnings to the highest finish of consensus. Shares rose 2.5pc.

Taylor Wimpey additionally introduced a cost-of-living cost of as much as £1,000 to assist employees with hovering gas prices.

The group stated it should make the cost to all workers on salaries of as much as £70,000, which means that round 90laptop of its workforce are eligible.

08:56 AM

EDF to chop nuclear output as French vitality disaster deepens

EDF has stated it is prone to make additional cuts to its nuclear reactor output in a transfer that may exacerbate the nation’s vitality disaster.

The French firm stated that energy stations on the Rhone and Garonne rivers will produce much less electrical energy within the coming days, although there will be a minimal stage of output to maintain the grid steady.

It comes amid a heatwave sweeping Europe, which is limiting the corporate’s potential to chill its vegetation.

Beneath French guidelines, EDF should scale back or halt nuclear output when river temperatures attain sure thresholds to make sure the water used to chill the vegetation received’t hurt the setting when put again into the waterways.

EDF, which is getting ready to nationalisation, has estimated that its nuclear output this yr would be the lowest in three many years.

08:39 AM

FTSE risers and fallers

The FTSE 100 has began the day on the again foot as buyers stay cautious over rate of interest rises forward of tomorrow’s Financial institution of England assembly.

The blue-chip index misplaced 0.3pc in its third day of losses after sturdy beneficial properties in July.

Shares in cybersecurity agency Avast soared 42laptop after the competitors watchdog provisionally cleared its £6bn takeover by rival NortonLifeLock.

Housebuilder Taylor Wimpey gained 3.5pc after elevating revenue steerage to the highest finish of expectations amid “sturdy” housing demand whilst rates of interest rise.

The domestically-focused FTSE 250 edged up marginally. Hiscox tumbled greater than 8pc after the insurer posted a pre-tax lack of $107.

08:19 AM

Simply Eat orders fall as pandemic growth fades

Simply Eat Takeaway has reported a drop in orders for the primary half of the yr as a pandemic-fuelled growth in demand light.

Complete orders fell 7pc within the first half of 2022 as a result of lifting of lockdowns and fewer individuals ordering meals to their properties.

Nonetheless, income within the UK and Eire rose 13laptop amid a push to enhance earnings from particular person meals gross sales.

Simply Eat forked out €414m (£346m) on advertising and marketing within the first six months of 2022 – a 40laptop enhance on final yr – following a cope with US-based Grubhub and launching a expensive promoting marketing campaign with Katy Perry.

It additionally wrote down the worth of US-based Grubhub by €3bn amid plunging inventory market valuations and rising rates of interest.

Jitse Groen, Simply Eat’s chief govt, stated:

After a interval of outstanding development, Simply Eat Takeaway.com is now two instances bigger than it was pre-pandemic.

While this development required vital funding, now we have continued to concentrate on executing our technique to construct and function extremely worthwhile meals supply companies.

08:13 AM

Avast will get inexperienced gentle for £6bn NortonLifeLock merger

The competitors watchdog has provisionally given the inexperienced gentle for British cybersecurity agency Avast’s £6bn merger with NortonLifeLock.

The Competitors and Markets Authority stated it doesn’t consider the tie-up raises competitors issues following an in-depth investigation.

Whereas issues had been raised in its preliminary probe, the CMA stated extra detailed evaluation discovered the merging companies face “vital competitors” from McAfee and a spread of smaller rivals.

The watchdog has set a deadline of August 24 for responses to its provisional choice, with a last report due by September 8.

Kirstin Baker, chair of the CMA inquiry group, stated:

Hundreds of thousands of individuals throughout the UK depend on cyber security providers to maintain them secure on-line.

After gathering additional data from the businesses concerned and different business gamers, we’re presently glad that this deal will not worsen the choices obtainable to shoppers.

As such, now we have provisionally concluded that the deal can go forward.

08:02 AM

FTSE 100 slips on the open

The FTSE 100 has misplaced floor on the open following a slide on Wall Road sparked by renewed US-China tensions.

The blue-chip index slipped 0.3pc to 7,390 factors.

07:58 AM

Bain banned from UK contracts over ‘grave misconduct’ in South Africa

Administration consultancy Bain & Co has been banned from British authorities contracts for 3 years due to its “grave skilled misconduct” in a serious corruption scandal in South Africa.

Cupboard Workplace minister Jacob Rees-Mogg advised the Boston-based firm he was not satisfied it had taken its position within the scandal “sufficiently significantly” and branded its integrity “questionable”, the Monetary Occasions stories.

The ban pertains to Bain’s involvement within the so-called state seize scandal in South Africa, which pertains to widespread corruption underneath former president Jacob Zuma.

The UK is the primary western nation to impose penalties on Bain, however the US is underneath stress to observe go well with.

Bain stated it was “stunned and disillusioned” on the choice and stated it might think about choices for a evaluation.

It added: “Within the meantime, we’ll proceed to work with the Cupboard Workplace to make sure that we do what’s required to revive our standing with the UK authorities.”

07:41 AM

Meta bosses ditch Silicon Valley

Sir Nick Clegg’s choice to partially relocate to London is the newest in a string of departure’s from the Fb group’s California headquarters.

Chief advertising and marketing officer Alex Schultz made the transfer earlier this yr, whereas Instagram chief Adam Mosseri is about to shift to the corporate’s King’s Cross base.

Different bosses to desert Silicon Valle are Man Rosen, chief data safety officer, who’s now primarily based in Israel, and Naomi Gleit, head of product, who’s in New York.

Javier Olivan, head of development, is dividing his time between California and Spain, in line with the FT.

Mr Zuckerberg himself divides his time between California and his house in Hawaii, the place he spent a variety of time early within the pandemic.

Learn extra on this story: Instagram chief relocates to London as Meta scrambles to counter TikTok

07:33 AM

Sir Nick Clegg joins Silicon Valley exodus

Good morning.

Sir Nick Clegg is partly relocating to the UK, changing into the newest high Meta official to ditch Silicon Valley.

The previous deputy prime minister turned social media govt will break up his time between properties in London and California, the Monetary Occasions.

It comes after Instagram boss Adam Mosseri stated he is transferring to London, whereas chief advertising and marketing officer Alex Schultz has additionally made the transfer.

Sir Nick, who’s in command of Meta’s dealings with governments around the globe, has been candid about his reluctance to stay in California. He is stated to be transferring to be nearer to his dad and mom and for ease of journey to Europe and Asia.

5 issues to start out your day

1) Workers to suffer record wage squeeze as Britain plunges into recession Hundreds of thousands of households’ financial savings to be worn out as inflation surges to 11laptop, forecaster warns

2) HSBC looking at ‘alternative structures’ as break-up pressure grows Offended buyers in Hong Kong name for the financial institution’s Asian operations to be spun-off

3) Record bookings at Airbnb as travel bounces back US firm expects to ship file income and earnings within the subsequent quarter

4) Star Observer columnist suspended after trans rights row Nick Cohen agrees to pause writing whereas GNM investigates allegations about his conduct by campaigner Jolyon Maugham

5) Ferrari to raise prices of luxury sports cars Booming demand has pushed up quarterly gross sales by 29laptop

What occurred in a single day

Asia-Pacific bond yields adopted US Treasury yields larger this morning and the greenback continued its climb after Federal Reserve officers signalled they’re nowhere close to performed elevating rates of interest.

Yields had been additionally helped as demand for the most secure property retreated following US Home Speaker Nancy Pelosi’s arrival in Taiwan. The safe-haven yen continued its slide.

That lifted shares in Asia, regardless of the slide on Wall Road in a single day.

Japan’s Nikkei gained 0.5pc, rebounding from Tuesday’s two-week closing low, whereas Chinese language blue chips jumped 0.9pc and Hong Kong’s Dangle Seng gained 0.8pc.

MSCI’s broadest index of Asia-Pacific shares edged 0.11laptop larger. Taiwan’s inventory benchmark was about flat, whereas Australian equities declined 0.5pc.

Arising in the present day

-

Company: Endeavour Mining, Ferrexpo, Hill & Smith Holdings, Hiscox, IP Group, Taylor Wimpey (interims)

-

Economics: Composite PMI (UK, US, EU), providers PMI (UK, US, EU), retail gross sales (EU), producer worth index (EU), manufacturing facility gross sales (US)

Source link