[ad_1]

(Bloomberg) — OPEC+ responded to surging volatility and rising market uncertainty by maintaining its oil manufacturing unchanged.

Most Learn from Bloomberg

The end result of the transient on-line assembly on Sunday displays the unpredictability of provide and demand within the coming months, and the wild gyrations in costs of the previous week.

The oil producers’ group has solely simply carried out the hefty 2 million barrel-a-day discount agreed at its final gathering. In the meantime, European Union sanctions on crude exports from Russia come into impact on Monday, and China is tentatively easing the Covid measures which have eroded its gasoline consumption.

Brent crude plunged to its lowest stage since September on Nov. 28, however ended up posting its largest weekly acquire in a month.

“With huge and offsetting elementary and geopolitical dangers bearing down on the oil market, ministers understandably opted to carry regular and hunker down,” mentioned Bob McNally, president of Rapidan Vitality Advisers LLC.

The choice by the Group of Petroleum Exporting Nations and its allies ought to maintain for at the very least a couple of months. The group’s Joint Ministerial Monitoring Committee, led by Saudi Arabia and Russia, will meet once more in February. The outlook may very well be clearer by then, and the panel has the ability to name extraordinary conferences if it thinks output coverage may have to alter.

The oil market may look fairly totally different by early 2023, with a number of probably historic shifts in provide and demand unfolding within the coming days and weeks.

As OPEC+ ministers convened their video convention, officers in Shanghai had simply eased a few of their Covid restrictions, becoming a member of different top-tier Chinese language cities as authorities speed up a shift towards reopening the financial system after hundreds of demonstrators took to the streets.

High authorities officers over the previous week have signaled a transition away from the harshest containment measures, which have weighed on the financial system on the earth’s largest oil importer.

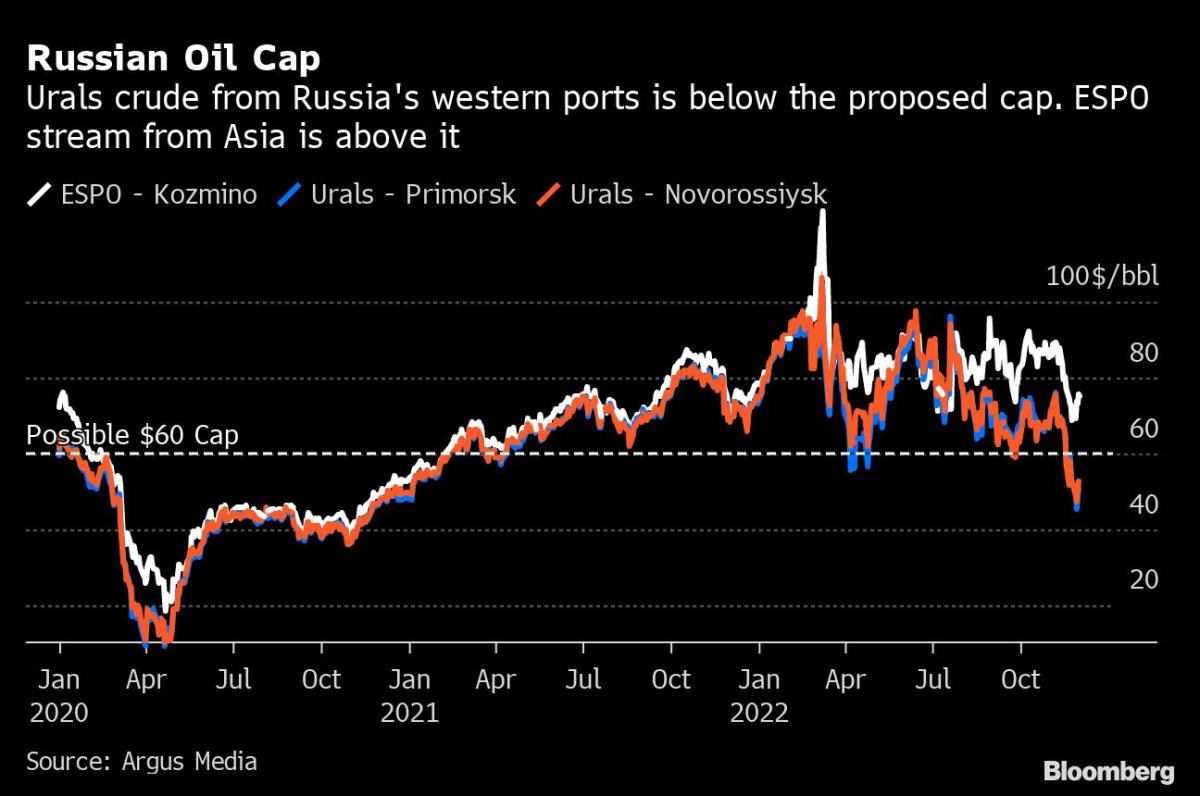

On Monday, the EU will ban most seaborne imports of Russian crude and block anybody else from utilizing the area’s transport or insurance coverage companies for purchases of Russian oil, until it’s carried out so under a $60-a-barrel worth cap.

It’s unclear to what extent these measures will curtail Russian exports. The worth cap is comfortably above the $50 that the nation’s flagship Urals grade of crude presently trades at, in keeping with information from Argus Media. But Moscow has mentioned it might quite lower manufacturing than promote oil to anybody that adopts the worth cap.

With these highly effective forces poised to push oil markets in unpredictable instructions, OPEC watchers mentioned the group’s choice was comprehensible.

“OPEC+ rolled over the prevailing quotas as anticipated amid uncertainty round Russian flows following the worth cap, and a weaker China,” mentioned Amrita Sen, chief oil analyst and co-founder at guide Vitality Points Ltd. “The group will proceed to watch markets and may fundamentals deteriorate they may meet previous to June — presently the scheduled subsequent ministerial assembly.”

The assembly on Sunday was a calmer affair than the final one again in October, which created a diplomatic spat. President Joe Biden slammed OPEC+ for the two million-barrel cutback, accusing Riyadh of aiding Russia’s struggle in Ukraine by bolstering costs. Since then, the market’s fluctuations have given the group a way of vindication.

The lower “was purely pushed by market issues, and acknowledged on reflection by the market contributors to have been the mandatory and the precise plan of action in direction of stabilizing world oil markets,” OPEC mentioned on Sunday.

–With help from Julian Lee.

(Updates with OPEC assertion)

Most Learn from Bloomberg Businessweek

©2022 Bloomberg L.P.

Source link