Opinion: Excellent news for retirees and retirement savers — inflation could also be working in your favor

[ad_1]

Retirees and people in search of safe revenue bought two gadgets of superb information this week, although chances are you’ll solely have heard about one.

In the meantime, your means to earn a assured charge of return on risk-free investments, no matter what occurs to inflation, truly went up.

So-called TIPS bonds, Treasury bonds protected towards inflation, fell barely in value this week. And because of this the rates of interest obtainable for brand new patrons went up. (Bonds work like seesaws: When the worth falls, the “yield” rises.)

A 5-year TIPS bond is now assured to beat inflation by 0.3% a yr between now and 2027, it doesn’t matter what inflation seems to be, and a 30-year TIPS bond is assured to beat inflation by practically a full proportion level per yr. That’s equal to a 35% rise in buying energy between now and 2052.

What’s going to occur to inflation over that point? I don’t know. Nor does anybody else. Some extraordinarily sensible and skilled monetary minds — together with fund managers David Einhorn at Greenlight Capital and Jonathan Ruffer in London — assume inflation goes to rise, and maintain rising. Einhorn not too long ago prompt that the recent retreat in inflation, to borrow final yr’s buzzword, is more likely to show “transitory.”

Might they be proper? President Joe Biden boasted this week that the inflation charge was now right down to 0%, on a month-to-month foundation, however on the similar time he identified, on Twitter, that the roles market is booming and staff have the bargaining energy that they haven’t had in many years — that means their wages are more likely to go up.

Rising wages wouldn’t be inflationary in the event that they have been matched by rising productiveness, however sadly the latest data show that labor productivity has plunged this year.

Discover ways to shake up your monetary routine on the Best New Ideas in Money Festival on Sept. 21 and Sept. 22 in New York. Be a part of Carrie Schwab, president of the Charles Schwab Basis.

So the individuals saying inflation hasn’t gone away might not be loopy.

However, you need to marvel about all these thousands and thousands of people who find themselves, maybe unwittingly, taking a giant gamble the opposite method.

That features anybody proudly owning common or nominal Treasury bonds. If you’re a retiree or a low-risk investor, and also you personal a normal form of lower-risk or balanced portfolio, that in all probability contains you.

See: An investor’s guide to the Inflation Reduction Act — and what the bill means for your portfolio

Additionally: Stock-market euphoria meets bond-market pessimism as ‘strange week’ comes to end

The usual (non-inflation-protected) 5-year Treasury observe yields about 3%. The 10-year yields much less, round 2.9%. The 30-year is simply barely above 3%. These yields make sense provided that you imagine that inflation has collapsed and can proceed to break down.

I’ve written right here earlier than about so-called break-evens, a technical measure within the bond market that successfully anticipates future inflation. Proper now the 5-year break-even is about 2.7%, and the 10-year is about 2.5%. What this implies is that anybody proudly owning a 5-year common Treasury bond, as an alternative of a 5-year TIPS bond, is unwittingly betting that inflation over the subsequent 5 years will common lower than 2.7% a yr. Anybody proudly owning a 10-year common Treasury bond, as an alternative of the 10-year TIPS bond, is betting that inflation will common lower than 2.5% between now and 2032.

That’s fairly a wager.

See: Fed’s Kashkari says July CPI is ‘first hint’ of possible good news on inflation

It’s a thriller to me why these conventional or old school Treasury bonds are nonetheless thought-about “threat free” property. They solely pay out nominal rates of interest. Purchase a bond paying 3% a yr for 10 years and see how freed from threat that’s if inflation is available in at one thing approaching 10% a yr.

Opinion: Inflation hasn’t peaked yet because rents are still rising fast

It’s, frankly, exhausting to see a lot upside in shopping for conventional bonds over TIPS. Even when inflation is available in low, how low is it going to be? And do you actually need to be making bets together with your retirement account?

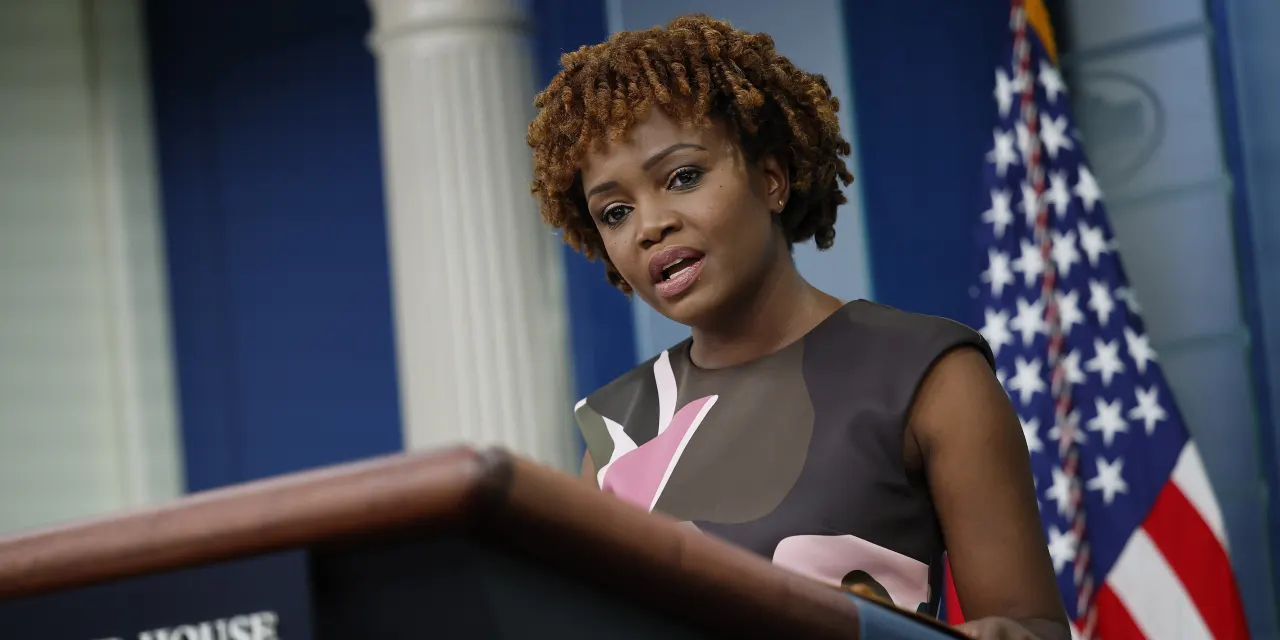

In the meantime, in case you missed it, the previous few days have led to a type of political debates concerning the “actual” inflation charge. The president, backed by his official spokesperson, has argued it’s actually 0% as a result of costs didn’t transfer between June and July. His critics have argued that the true charge is 8.5%, as a result of that’s the change in costs in July from a yr earlier.

I’m not unsympathetic to the case for taking a look at the latest month-to-month value rise. It’s, in spite of everything, the most recent knowledge. However extrapolating from that to “inflation is 0%” is the sort of public-relations stretch that turns a great knowledge level right into a punchline.

In the meantime, I’ve a suggestion.

To all these individuals enthusing that the true charge of inflation is now 0%, go wager on it. Exit and purchase zero coupon 30-year bonds, locking in 3.1% curiosity per yr between now and 2022 and 2052. Should you’re proper, you’ll make out like bandits.

Good luck.

In the meantime, for those who stay in the true world and also you pay actual costs in actual shops, and also you don’t a lot really feel like playing your life financial savings on future financial indicators, TIPS bonds over common Treasurys appears to be like like a simple option to me.

Source link

Recent Posts

Starting Your Journey in Online Sports Betting

Online sports betting has become a popular pastime for many, offering lots of excitement and…

Understanding Pishbini Betting Forecasts Explained

Introduction to Pishbini Betting Forecasts Pishbini Betting Forecasts have steadily gained attention in the betting…

Exploring High 5 Casino’s Latest Releases

High 5 Casino has carved a niche for itself by offering a rich variety of…

The History and Development of Viagra

Introduction Viagra is more than a household name; it is a revolutionary medication that reshaped…

Exploring the Features of Olxtoto Casino

Olxtoto Casino is an online platform that has captured the attention of gamers with its…

Benefits of Oxnard Asphalt Paving Services: Ultimate Advantages

Introduction Oxnard Asphalt Paving Services has become a cornerstone of modern infrastructure, blending cutting-edge technology…