[ad_1]

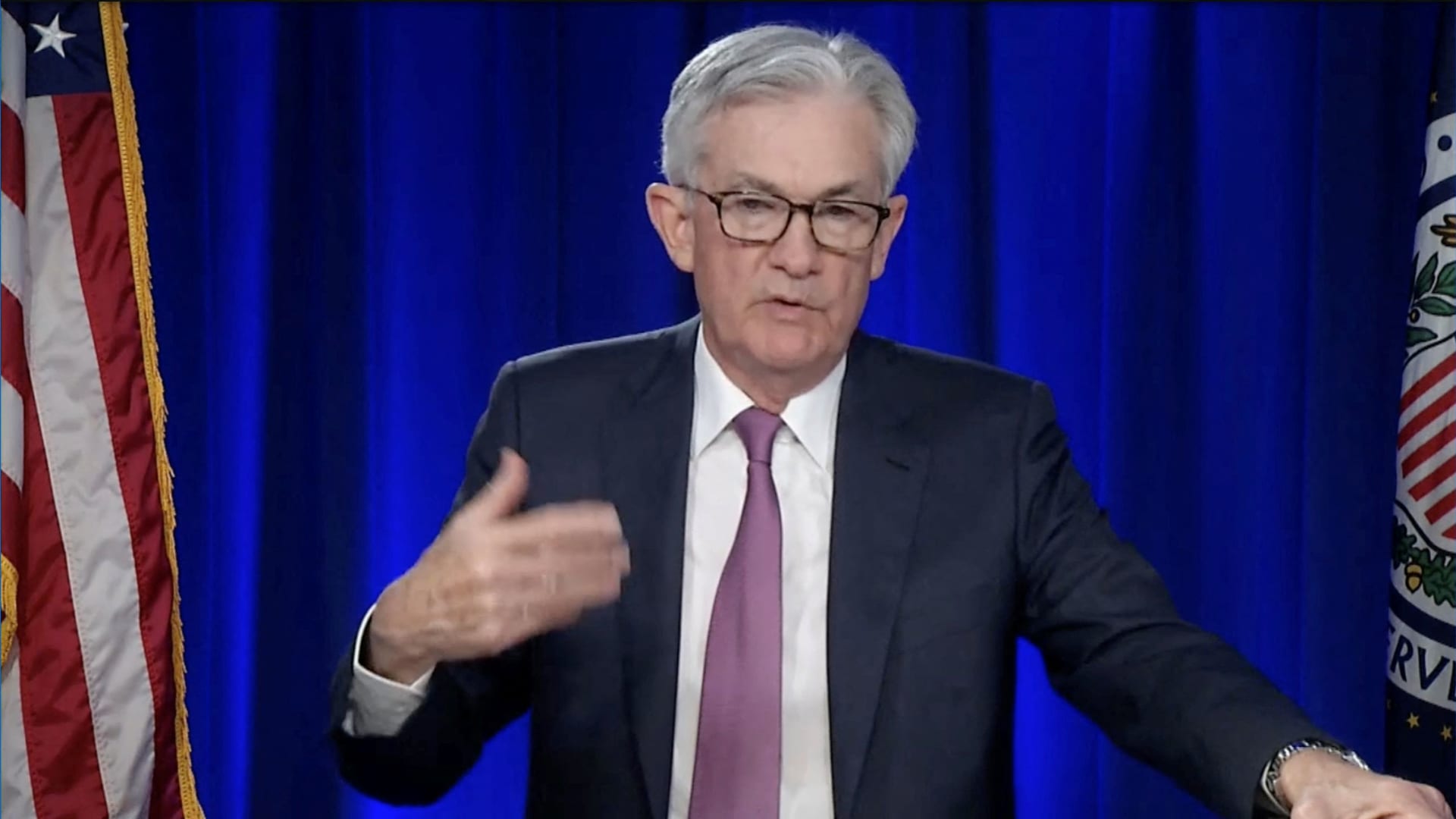

U.S. Federal Reserve Chairman Jerome Powell addresses an internet solely information convention in a body seize from U.S. Federal Reserve video broadcast from the Federal Reserve constructing in Washington, U.S., January 26, 2022.

U.S. Federal Reserve | by way of Reuters

Federal Reserve Chairman Jerome Powell on Monday vowed robust motion on inflation, which he mentioned jeopardizes an in any other case robust financial restoration.

“The labor market may be very robust, and inflation is far too excessive,” the central financial institution chief mentioned in ready remarks for the Nationwide Affiliation for Enterprise Economics.

The speech comes lower than every week after the Fed raised interest rates for the primary time in additional than three years in an try to battle inflation that’s working at its highest stage in 40 years.

Reiterating a place the Federal Open Market Committee made Wednesday in its post-meeting statement, Powell mentioned rate of interest hikes would proceed till inflation is underneath management. He mentioned the will increase could possibly be even increased if needed than the quarter-percentage-point transfer authorized on the assembly.

“We’ll take the required steps to make sure a return to cost stability,” he mentioned. “Particularly, if we conclude that it’s acceptable to maneuver extra aggressively by elevating the federal funds charge by greater than 25 foundation factors at a gathering or conferences, we are going to achieve this. And if we decide that we have to tighten past widespread measures of impartial and right into a extra restrictive stance, we are going to try this as properly.”

A foundation level is the same as 0.01%. FOMC officers indicated that 25 foundation level will increase are probably at every of their remaining six conferences this yr. Nevertheless, markets are pricing in a few 50-50 probability the subsequent hike, on the Could assembly, could possibly be 50 foundation factors.

‘Extensively underestimated’ inflation

The sudden coverage tightening comes with inflation as measured by the consumer price index working at 7.9% on a 12-month foundation. A measure that the Fed prefers nonetheless has prices up 5.2%, properly above the central financial institution’s 2% goal.

As he has earlier than, Powell ascribed a lot of the pressures coming from pandemic-specific components, specifically escalated demand for items over providers that offer couldn’t meet. He conceded that Fed officers and plenty of economists “extensively underestimated” how lengthy these pressures would final.

Whereas these aggravating components have endured, the Fed and Congress supplied greater than $10 trillion in fiscal and financial stimulus for the reason that pandemic’s begin. Powell mentioned he continues to imagine that inflation will drift again to the Fed’s goal, nevertheless it’s time for the traditionally straightforward insurance policies to finish.

“It continues to look probably that hoped-for supply-side therapeutic will come over time because the world in the end settles into some new regular, however the timing and scope of that reduction are extremely unsure,” mentioned Powell, whose official title now’s chairman professional tempore as he waits Senate affirmation to a second time period. “Within the meantime, as we set coverage, we can be trying to precise progress on these points and never assuming vital near-term supply-side reduction.”

Powell additionally addressed the Russian invasion of Ukraine, saying it’s including to produce chain and inflation pressures. Beneath regular circumstances, the Fed typically would look by way of these forms of occasions and never alter coverage. Nevertheless, with the result unclear, he mentioned policymakers need to be cautious of the scenario.

“In regular instances, when employment and inflation are near our targets, financial coverage would look by way of a quick burst of inflation related to commodity value shocks,” he mentioned. “Nevertheless, the danger is rising that an prolonged interval of excessive inflation might push longer-term expectations uncomfortably increased, which underscores the necessity for the Committee to maneuver expeditiously as I’ve described.”

Powell had indicated final week that the FOMC additionally is ready to start working off among the practically $9 trillion in property on its stability sheet. He famous that the method chilly start as quickly as Could, however no agency choice has been made.

Source link