[ad_1]

Oil giants together with Saudi Arabia will likely be boosted by an increase in European oil demand as Vladimir Putin shuts off the continent’s gasoline faucets, specialists have warned.

World oil consumption is about to leap by 2.1m barrels a day this yr as factories and energy turbines attempt to dodge rocketing gasoline costs, the Worldwide Power Company mentioned.

The Paris-based company mentioned this additional demand could be “overwhelmingly concentrated” within the Center East and Europe.

It warned the rise in oil demand would emerge in opposition to a backdrop of tighter provide, with Russia reducing down on manufacturing because the EU prepares sanctions on its oil.

Specialists mentioned Russian oil manufacturing will drop by a fifth within the early months of subsequent yr because the bloc’s sanctions on imports kick in.

06:06 PM

Wrapping up

That is all from us at this time, thanks for following! Earlier than you go, try the most recent tales from our repoters:

06:05 PM

McDonald’s to restart operations in Ukraine

McDonald’s plans to reopen its eating places in Ukraine over the following few months in an early signal of western companies returning to the nation, even because the battle with Russia continues.

The world’s largest burger chain closed all its eating places in Ukraine and Russia in March, following Moscow’s invasion of the japanese European nation.

McDonald’s had 109 eating places in Ukraine, however didn’t specify what number of it deliberate to reopen. The corporate has continued to pay greater than 10,000 employees within the nation because the eating places had been closed.

The choice to reopen got here after “in depth session and dialogue with Ukrainian officers, suppliers, and safety specialists, and in consideration of our staff’ request to return to work,” Paul Pomroy, McDonald’s head of worldwide operated markets, mentioned in a message to staff.

05:43 PM

FTSE 100 closes within the pink

The FTSE 100 has closed decrease because the prospect of upper US rates of interest saved buyers cautious.

The index dropped 0.6pc, with drugmaker GSK sliding by a tenth amid a litigation targeted on a heartburn drug that contained a possible carcinogen. Haleon, GSK’s lately spun off shopper well being unit, dropped 4.9pc.

Wall Road indexes edged greater after a rally the earlier session, as indicators of cooling inflation decreased bets of a supersized fee hike by the Federal Reserve subsequent month. Policymakers mentioned they are going to hold tightening financial coverage till value pressures are totally damaged.

“Market pricing means that buyers are extra dovish than what we might count on the Fed to ship,” mentioned Karim Chedid, BlackRock’s head of funding technique for its iShares unit within the EMEA area. “You would see extra volatility in fee and fairness markets.”

05:23 PM

Hovering rates of interest holding again property gross sales, warns Savills

Larger rates of interest are sending a chill by means of the housing market, Savills has warned. Helen Cahill experiences:

The high-end property agent’s UK revenues declined by 8pc to £95.8m for the primary six months of the yr “in opposition to the backdrop of a lot decreased inventory availability and rising rates of interest”.

Gross sales volumes plummeted by 22computer in London and 39computer within the areas because the property market cooled following a growth throughout the pandemic. Income from Savill’s residential enterprise within the UK fell by 34computer to £13.6m.

Savills mentioned the prime phase of the property market was affected by an absence of homes available on the market, suggesting wealthy owners have gotten extra reluctant to promote.

Larger rates of interest are additionally taking the warmth out of value rises, with Savills reporting: “Worth development has begun to average in response to the rising price of debt specifically.”

05:02 PM

Coca-Cola HBC sees income enhance regardless of hit from Russia exit

The European distributor of Coke has seen a soar in income regardless of taking a success in Russia after the nation invaded Ukraine.

Coca-Cola HBC posted a 29.6pc hike in income to €4.2bn (£3.6bn) within the first six months of the yr. Income dropped 34.4pc to €152.9m in comparison with final yr.

It mentioned operations in Russia will likely be “considerably smaller” going ahead because it focuses on native manufacturers which will likely be £instantly operationally and financially self-sufficient”.

In March, the bottler stopped putting orders for focus of The Coca-Cola Firm’s branded merchandise in Russia, in addition to stopping funding within the nation. Volumes in Russia plunged 46computer in Q2 and the agency expects some additional declines within the coming months.

04:41 PM

Gamblers reducing bets amid cost-of-living disaster, says Ladbrokes proprietor

Gamblers are putting fewer and smaller bets as the price of dwelling disaster bites, the proprietor of Ladbrokes mentioned. Hannah Boland has the story:

Entain, which additionally owns Coral betting retailers, mentioned it was “not immune” to financial pressures, with prospects in nations the place inflation is working highest making the largest cutbacks on wagers. In some areas, spend-per-head is down by 10computer, Entain mentioned.

Deputy chief govt and chief monetary officer Rob Wooden mentioned: “These prospects are nonetheless with us, so it isn’t that they’ve stopped spending cash on sports activities betting or gaming, however they’re simply spending much less, and in some nations, that is 90computer of what they’d ordinarily spend, in order that’s nice resilience”.

Regardless of indicators of strain on prospects’ budgets, Mr Wooden mentioned the price of dwelling disaster may increase playing companies if folks in the reduction of on going out and as an alternative spend extra time at dwelling making on-line bets.

04:19 PM

Amazon employees in Bristol protest over pay

Amazon employees in Bristol are staging a protest at this time after the corporate provided a 35p per hour enhance, equal to £10 per week for the typical employee.

Andy Prendergast, nationwide secretary of the GMB union, mentioned: “Amazon employees are saying clearly – sufficient is sufficient. They want a good pay rise from one of the crucial worthwhile corporations on earth.

“When the excessive road was shut as a consequence of Covid, Amazon continued to generate profits. It’s only honest that they share this with the individuals who do the work for his or her enterprise.”

04:01 PM

Handover

I’m handing over to my colleague Giulia Bottaro, who’ll steer this weblog onwards with aplomb. Thanks for following alongside.

03:58 PM

Hong Kong suffers report inhabitants stoop

Hong Kong has suffered the sharpest inhabitants drop on report as folks flee political crackdowns and its stringent Covid insurance policies.

Town misplaced 113,200 residents within the yr to June, leaving its inhabitants at 7.3m, based on knowledge launched by its authorities.

The 1.6pc fall was the biggest in at least six decades, and marked the third consecutive yr of declining inhabitants.

The tempo was a few third greater than the earlier yr, when 89,200 residents left.

03:24 PM

Carney will get new function at asset supervisor

Talking of Financial institution of England governors… Andrew Bailey’s predecessor on the tiller of Threadneedle Road, Mark Carney, is taking over a job because the chairman of Canadian asset supervisor Brookfield’s soon-to-be-listed spinout.

The Canadian firm is trying to spin out 25computer of its asset administration operations in an inventory later this yr. Mr Carney will chair the brand new unit.

Chief govt Bruce Flatt mentioned:

As we glance to the following part of our development, and concurrent with the split-out of our Asset Administration enterprise earlier than the top of 2022, we consider it’s as soon as once more time to additional strengthen our senior administration staff with the elevation of the following technology of leaders.

02:52 PM

Bailey warns Truss in opposition to tampering with Financial institution of England

Andrew Bailey has warned Liz Truss to not problem the Financial institution of England’s rule making powers and alter its mandate, as tensions between Threadneedle Road and ministers proceed to escalate.

My colleague Simon Foy experiences:

In a letter to the Treasury committee, the Governor of the Financial institution of England mentioned curbing the establishment’s independence may harm its worldwide popularity.

Mr Bailey additionally indicated his opposition to a proposal that might enable ministers to reverse any decisions made by City regulators if they’re seen to be holding again post-Brexit reforms.

02:24 PM

US producer costs ease

US producer costs eased in July, in an extra signed value pressures are cooling on the planet’s largest financial system.

Our economics editor, Szu Ping Chan, has the main points:

US manufacturing facility gate costs eased again in July, in one other signal that inflation on the planet’s largest financial system could have peaked.

Producer costs fell 0.5pc on the month, in contrast with an anticipated rise of 0.2pc. This took the annual fee to 9.8pc in July, far decrease than the 11.3pc rise recorded in June.

Economists mentioned the drop principally mirrored a drop in power prices. It is also one other signal that costs within the retailers may even begin to average. S&P 500 futures had been boosted by the information. US shares are anticipated to open greater.

02:20 PM

McDonald’s to begin reopening Ukraine eating places

In a sign western companies are looking for a return to Ukraine, McDonald’s mentioned it might look to reopen a few of its shops within the war-torn nation over the following few months.

In a be aware to staff seen by Reuters, McDonald’s mentioned:

After in depth session and dialogue with Ukrainian officers, suppliers, and safety specialists, and in consideration of our staff’ request to return to work, we now have determined to institute a phased plan to reopen some eating places in Kyiv and western Ukraine.

The quick meals large didn’t specify what number of eating places it deliberate to reopen, after closing all 109 of its retailers in March following Russia’s invasion.

McDonald’s lately revealed a $1.4bn hit from closing its 850 Russian restaurants amid a wider exodus of western corporations from Putin’s nation. The Kremlin promptly opened a copycat model of McDonald’s, called “Tasty, and that’s it”.

01:28 PM

OPEC expects oil market surplus in break with IEA

Oil-producer cartel OPEC mentioned world oil markets will enter a surplus this yr because it reduce its demand forecast – placing it at odds with the IEA’s extra bullish outlook.

Bloomberg experiences:

The Group of Petroleum Exporting Nations reduce forecasts for the quantity of crude it might want to pump within the third quarter by 1.24 million barrels a day to 28.27 million a day, based on its newest month-to-month report. That’s about 570,000 barrels a day lower than OPEC’s 13 members pumped in July.

01:18 PM

Readout from power talks: not a lot

The Treasury has revealed a readout the Prime Minister, chancellor and enterprise secretary’s roundtable with the electrical energy sector this morning.

Boris Johnson turning up is sudden, however aside from that it appears like there’s not a lot new taking place.

HMT says:

The Chancellor and power corporations agreed to work carefully over the approaching weeks to make sure that the general public, together with weak prospects, are supported as unprecedented world occasions drive greater power prices.…

As set out within the Power Safety Technique, the Authorities has launched a session to drive ahead market reforms and make sure the market works higher for customers. Dialogue targeted on how Authorities and trade can collectively drive ahead reforms to make sure the market delivers decrease costs.

Per the outgoing PM:

We all know that this will likely be a troublesome winter for folks throughout the UK, which is why we’re doing every little thing we are able to to help them and should proceed to take action.

Following our assembly at this time, we’ll hold urging the electrical energy sector to proceed engaged on methods we are able to ease the price of dwelling pressures and to take a position additional and quicker in British power safety.

“Every part we are able to” is carrying a whole lot of water there given the Authorities hasn’t introduced new help in about three months.

Per the (additionally in all probability outgoing) chancellor, Nadhim Zahawi:

This morning I hosted trade leaders from the electrical energy sector to debate what extra they’ll do to work with Authorities and act within the curiosity of the nation within the face of rising costs brought on by Putin’s unlawful invasion of Ukraine.

We have now already acted to guard households with £400 off power payments and direct funds of £1,200 for eight million of probably the most weak British households. Within the spirit of nationwide unity, they agreed to work with us to do extra to assist the individuals who most want it.

12:56 PM

Winter vacation blow for Wales as Wizz scraps flights

Winter solar holidays from Wales have been scuppered as Wizz Air cancels flights to seaside locations from Cardiff airport.

My colleague Helen Cahill experiences:

The funds airline is reducing journeys to 9 vacation spots blaming “financial pressures” as post-pandemic pressures continue to hamper the travel industry.

The airline has stopped promoting tickets to Alicante, Corfu, Heraklion, Faro, Larnaca, Lanzarote, Palma de Mallorca, Sharm El-Sheikh and Tenerife from September 19.

Holidaymakers who’ve already purchased their tickets will be capable to rebook comparable flights to go subsequent summer time from Cardiff or journey from London Gatwick or Luton Airport this winter.

12:39 PM

GSK slumps 12computer in largest fall since 1998 on heartburn drug fears

Ouch. Shares in GlaxoSmithKline have slumped 12computer – the largest drop since 1998 – amid issues about litigation over the heartburn drug Zantac.

The pharma large and Haleon, its lately spun-out shopper items wing, are each deep within the pink.

Zantac, a once-popular antacid, is the centre of a number of US lawsuits that declare it causes cancers.

Sanofi, GSK and Boehringer Ingelheim, together with a number of different generic drugmakers, are accused of failing to warn customers concerning the product’s dangers.

12:29 PM

Delivery boss says freight costs beginning to ease

The boss of one of many world’s largest transport corporations has mentioned there are indicators hovering freight charges could be easing off.

Rolf Habben Jansen, chief govt of Hapag-Lloyd, mentioned:

We’re at the moment seeing the primary indicators in some commerce lanes that spot charges are easing available in the market. The at the moment nonetheless strained state of affairs within the world provide chains ought to enhance after this yr’s peak season

It got here as his firm reported a near-doubling in income to €17bn within the first half of the yr.

12:04 PM

Scholz guarantees extra aid for Germans

German chancellor Olaf Scholz has pledged his authorities with do extra to supply aid within the face of hovering power payments.

Talking at a press convention, he mentioned Germany “will do every little thing we are able to to make sure that residents get safely by means of this era”.

The nation faces rationing, with almost half its properties reliant on gasoline for heating. Mr Scholz is beneath strain to avert a winter disaster.

Earlier this week, finance minister Christian Lindner mentioned the nation would enhance the bottom tax-free allowance and likewise deliver up the extent at which the nation’s 42computer high revenue tax fee kicks in to assist counter hovering inflation.

11:53 AM

Full report: Power payments to high £5,000 subsequent yr

We have now a full report up on warnings family power payments will soar to greater than £5,000 a yr subsequent April, based on a grim new forecast.

Right here’s an extract:

Ofgem, the power regulator, could need to set the value cap at £5,038 per yr for the typical dwelling amid elevated gasoline costs, power consultancy Auxilione mentioned.

Specialists mentioned the cap may hit £4,467 in January, which is prone to be a extra worrying determine for households as they use probably the most power in winter. Such a state of affairs would depart the typical family paying £571 for power in January.

They warned the cap is prone to stay above £4,000 all through subsequent yr.

Ministers are holding disaster talks with utility bosses at this time to debate how help for households could be improved.

11:20 AM

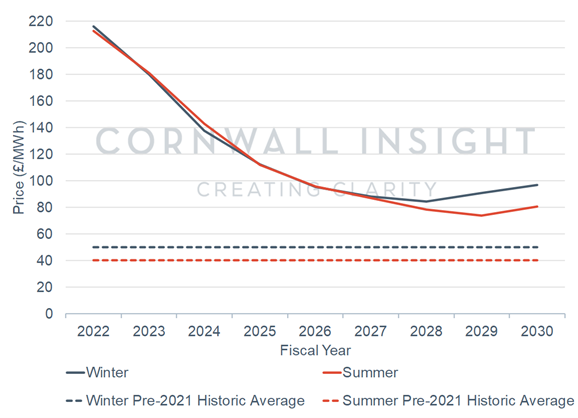

UK energy costs to stay above pre-2021 common for subsequent decade, analysts warn

UK energy costs are predicted to stay above the the pre-2021 common for the following decade regardless of a downwards push from renewables, analysts have mentioned.

Cornwall Perception say costs will fall beneath £100 per megawatt hour from 2026 onwards.

It’s an enchancment from an earlier forecast that noticed costs staying above the £100 mark by means of the last decade.

Tom Edwards, a senior modeller on the consultancy, mentioned:

Our knowledge reveals the advantages to the market of a development in renewable funding, with the rising competitors for GB renewables decreasing costs and serving to stabilise the power market over the following few years…

Whereas that is optimistic information, we have to recognise that costs are forecast to stay above pre-2021 common till 2030. It is crucial that the UK and others keep the course on low carbon technology, which alongside different measures to extend power safety resembling further nuclear or various gasoline imports, will likely be one of many key gamers on this journey.

11:06 AM

Rhine ranges set for additional plunge

Water ranges within the Rhine, Germany’s essential waterway, are set to drop even decrease than beforehand forecast within the coming days.

Water ranges at Kaub, a key chokepoint on the river, will drop to 33 centimetres by the 15th, based on the German Federal Waterways and Delivery Administration.

Under 40cm, that part of the river turns into successfully impassable for barges.

10:47 AM

Cash round-up

Listed here are a number of the day’s high tales from the Telegraph Cash staff:

10:24 AM

Ministers set for talks with power bosses

As talked about earlier, at this time’s scary value cap forecasts coincide with a crunch assembly between ministers and power sector bosses about how households could be supported.

PA experiences:

Chancellor Nadhim Zahawi and Enterprise Secretary Kwasi Kwarteng will press gasoline and electrical energy firm executives for options to the expected spike in payments over winter.…

Executives are being requested to submit a breakdown of anticipated income and payouts, in addition to funding plans for the following three years.

Ben Marlow, our chief metropolis commentator, shouldn’t be impressed. He writes:

What is that this meant to realize? Until one other windfall tax is deliberate to pay for extra help on power payments – placing apart the short-sightedness of such taxes – it dangers being the same old performative gesture politics.

10:05 AM

Russian oil output to drop by a fifth subsequent yr as import ban kicks in, says IEA

Russian oil output will drop by a fifth subsequent yr because the European Union’s import ban kicks in, the Worldwide Power Company has mentioned.

Bloomberg experiences:

Gradual month-to-month declines will begin as quickly as this month as Russia cuts again refining, and can quicken because the embargo takes impact, the IEA mentioned in a market report. The company expects to see near 2 million barrels a day shut in by the beginning of 2023, regardless of a wholesome restoration in manufacturing in latest months.

The EU is about to halt most crude purchases from Russia from Dec. 5 in a bid to chop off income streams that the Kremlin makes use of to finance its warfare in Ukraine. From Feb. 5, an EU ban on Russian oil-product shipments takes impact…

Russia’s oil output has risen prior to now three months, reaching virtually 10.eight million barrels a day in July amid greater home crude-processing and sturdy exports because the nation redirects crude flows to Asia.

09:48 AM

Newest ONS knowledge factors to exercise slowdown

The Workplace for Nationwide Statistics’ newest spherical of quicker indicators are fairly blended, with a 5pc fall in seated diners among the many most notable shifts.

The quantity of on-line job adverts was broadly unchanged on the earlier week, bu t5pc decrease than the identical time a yr in the past.

Apparently:

Roughly 5pc of companies with 250 or extra staff provided a one-off price of dwelling fee to their staff within the final three months; this compares with 1pc of companies with fewer than 250 staff providing a fee.

You may study the stats additional right here:

09:31 AM

Heathrow boss: Flight cap has reduce delays

Heathrow boss John Holland-Kaye has defended the airport’s controversial flight cap, saying it has decreased delays.

The highest airport’s 100,000 each day departing passenger restrict has resulted in improved efficiency, he mentioned, including:

Passengers are seeing higher, extra dependable journeys because the introduction of the demand cap.

The airport mentioned 88computer of its passengers are actually clearing safety with 20 minute, after it introduced in 1,300 new safety employees following extreme hold-ups.

09:23 AM

Drax drops after Kwarteng says burning picket pellet not sustainable

Energy firm Drax has fallen as a lot as 11computer at this time after Kwasi Kwarteng, the enterprise secretary, mentioned the corporate’s means of importing wooden pellets from the US to burn shouldn’t be sustainable.

Mr Kwarteng mentioned the method “doesn’t make any sense”, the Monetary Occasions experiences.

Kwasi Kwarteng additionally advised MPs that the federal government had not totally investigated the sustainability of burning wooden pellets, a kind of biomass. He mentioned the Division for Enterprise, Power and Industrial Technique had mentioned biomass with trade however “we haven’t really questioned a number of the premises” of the sustainability of pellets.

08:50 AM

US petrol drops beneath $Four a gallon in increase for Biden

US petrol costs have fallen beneath $Four a gallon for the primary time since March, as inflationary pressures proceed to ease on the planet’s largest financial system.

The autumn — a lift for President Joe Biden, who has made decreasing pump costs a precedence — follows a softer-than-expected inflation studying yesterday.

08:29 AM

FTSE 100 flat

I seem to have overpromised on the FTSE – regardless of futures indicating a achieve of about 0.1pc within the run-up to the open, Britain’s blue-chip index rose as a lot as… 0.08computer. It’s now down 0.06computer.

Not wanting like a day to jot down dwelling about (or textual content the household WhatsApp group about) for London.

08:24 AM

These gasoline costs…

Right here’s a reminded of how Europe’s benchmark gasoline costs have shifted in latest month (these are Dutch 1-month future, in euros/MWh):

Auxilione says:

The latest heatwave throughout Europe has decreased water ranges that means the nuclear energy technology is beneath risk as a consequence of an absence of cooling water. In Norway, an analogous story with water ranges that means much less hydro technology potential. If we glance in direction of coal and lignite, that always requires supply by ships that are unable to journey in low water ranges making that extraordinarily troublesome.

The market’s response relies on dealing with right into a sequence of choices which can be rapidly being exhausted for Europe because it seeks to seek out options to Russian gasoline.

08:19 AM

New forecast predicts power value cap will high £5,000 subsequent April

A brand new grim milestone in power forecasts: consultancy Auxilione says they count on Ofgem’s power value cap to high £5,000 subsequent spring.

The consultancy predicted the regulator will push the cap to £5,038 subsequent April, based mostly on continued elevation in gasoline costs and a pointy upwards transfer yesterday.

Its analysts mentioned:

Right now the UK authorities has referred to as in power corporations to try to discover a solution to work collectively to deliver down costs. It appears there may be little appreciation for simply how inconceivable that job actually is and that power corporations and the federal government have little management over this in such a globally influenced market.

07:58 AM

Economist: ‘Matter of time’ earlier than home costs fall

Regardless of the still-upbeat evaluation of surveyors, Capital Economics’s Andrew Wishart reckons it’s “only a matter of time” earlier than home costs comply with exercise decrease.

Commenting on the RICs survey, he mentioned:

Whereas we suspect provide will stay tight, we don’t assume that will likely be sufficient to forestall a drop in costs. With the brand new purchaser enquiries steadiness nonetheless decrease than the gross sales directions steadiness, the survey stays in step with costs falling by the top of the yr.

Right here’s that relationship, charted:

Mr Wishart added:

Different commentators are arguing that tight provide will help costs. However the historic report reveals that will increase in rates of interest of the size we’re seeing now could be at all times a precursor of home value falls.

07:44 AM

Period of €10 flights is over, says Ryanair boss

The age of the €10 aircraft ticket is over amid hovering gas prices, the chief govt of Ryanair has warned.

Michael O’Leary mentioned the funds airline’s common fare would rise over the approaching years, from €40 to round €50 within the subsequent half decade.

He advised the BBC’s Right now programme:

There’s little doubt that on the decrease finish of {the marketplace}, our actually low cost promotional fares – the one euro fares, the €0.99 fares, even the €9.99 fares – I feel you’ll not see these fares for the following variety of years…

We predict folks will proceed to fly steadily. However I feel persons are going to develop into rather more value delicate and subsequently my view of life is that individuals will commerce down of their many tens of millions.

07:34 AM

Truss-backing economist: let banks lend to get renters on housing ladder

RICS’ report comes as a separate paper referred to as on policymakers to shake-up mortgage guidelines and take away pink tape stopping tens of millions of renters from getting on the housing ladder.

Gerard Lyons, former financial adviser to prime minister Boris Johnson, urged the federal government to maneuver away from taxpayer-funded schemes and provides banks the facility to lend more cash to folks they assume are much less dangerous.

The influential economist, who’s backing Liz Truss to develop into the following prime minister, additionally mentioned renters ought to be allowed to make use of their fee historical past to spice up their probabilities of getting a mortgage.

Longer fixed-rate offers and greater mortgages for safer debtors would additionally get extra folks on the ladder, he mentioned. Mr Lyons claimed as much as three million folks may gain advantage from the modifications.

07:24 AM

Provide stays essential regardless of fee worries

Whilst rising mortgage charges, falling actual wages and recession fears drag on the demand facet of the housing market, it’s provide – or a extreme lack thereof – that underpins surveyors’ bullish view on costs. Per RICS:

Costs proceed to rise throughout all elements of the UK, even when the speed of development has softened in lots of instances in contrast with earlier within the yr. Restricted provide accessible remains to be seen as an important issue underpinning the market.

Rental demand additionally remained robust, based on RICS, with a web steadiness of 36computer of property professionals reporting a rise. Nevertheless, with extra landlords taking their properties off the market, rents are additionally anticipated to rise within the near-term.

07:16 AM

Agenda: Home costs rise regardless of rates of interest pushing up prices for consumers

Good morning. Quickly-rising rates of interest gained’t take the warmth out of the UK’s housing market, a brand new report says.

The Royal Establishment of Chartered Surveyors (RICS) says an absence of properties coming onto the market will offset waning curiosity from consumers within the coming yr.

A scarcity of properties on the market is predicted increase costs, whilst purchaser curiosity wanes, based on the Royal Establishment of Chartered Surveyors (RICS).

Whereas gross sales continued to say no in July in contrast with the earlier month, RICS mentioned a web steadiness of 63computer of surveyors reported a rise in home costs reasonably than a decline.

This “firmly upward development” was reported throughout the UK, and is predicted to proceed over the following 12 months, RICS mentioned.

In the meantime, the FTSE 100 is about for a light rally as aid from yesterday’s cooler-than-expected US inflation figures buoys markets.

5 issues to begin your day

1) How stealth taxes became Gordon Brown’s grimmest legacy Frozen thresholds amid hovering inflation imply one employee in each 9 pays the upper fee of revenue tax

2) Britain faces threat of rolling blackouts as electricity rationing becomes ‘load shedding’ As provides falter, the UK may see the primary managed decline of its power system for many years

3) Top banker quits after telling female colleague he needed ‘love and affection’ Citigroup dealmaker Jan Skarbek was suspended after allegedly making the feedback on a employees getaway

4) Russia starts stripping aircraft for parts as sanctions bite Aeroflot pressured to cannibalise planes to maintain flying

5) Disney plans ad-funded version of streaming service in battle with Netflix Marvel and Star Wars proprietor defies slowdown fears with huge soar in subscribers

What occurred in a single day

Hong Kong shares opened with small beneficial properties on Thursday, with the Grasp Seng Index climbing 1.17 per cent, or 229.73 factors, to 19,840.57.

The Shanghai Composite Index added 0.42 per cent, or 13.45 factors, to three,243.47, whereas the Shenzhen Composite Index on China’s second change rose 0.47 per cent, or 10.18 factors, to 2,191.01.

Arising at this time

-

Company: Antofagasta, Coca-Cola HBC, Derwent London, Entertain, M&G, Community Worldwide Holdings, OSB Group, Petrofac, Prudential, Savills, Spirax-Sarco Engineering (interims)

-

Economics: Jobless claims (US), producer value index (US)

Source link