[ad_1]

Morningstar lately in contrast the numbers on totally different situations for buyers who could also be considering of pausing their 401(okay) contributions. The consequence was not favorable for individuals who opted to cease contributing to their retirement plans, and the information confirmed that it hardly ever ever is.

After evaluating those that continued investing to others who withheld and tried out the “wait and see” strategy, the top return was fairly drastic by way of {dollars} earned and {dollars} misplaced. Let us take a look at their outcomes and see an instance of what you can stand to lose must you select to pause your retirement investing.

Buyers needing steering on making a resistant retirement plan can discover help via a monetary advisor. You possibly can join with a monetary advisor at no cost in simply 5 minutes.

Ought to Buyers Ever Pause 401(okay) Contributions?

Buyers ought to keep away from pausing their 401(okay) contributions throughout a bear market, recession or market downturn. The loss in compounding earnings sometimes outweighs any potential for financial savings you suppose you are getting by holding the money out of your retirement financial savings.

The Morningstar Comparability: Continued Contributions vs. Paused Investing

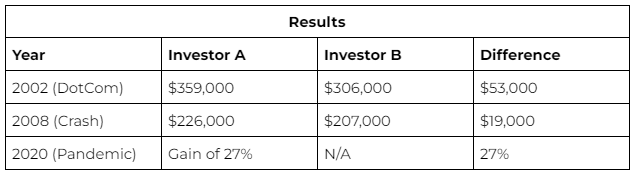

Morningstar ran the numbers from the earlier three main market upsets; 2002, 2008 and 2020. It created a easy comparability to find out who ended up forward – (A) an investor who continued making $500 month-to-month contributions or (B) a conservative investor who paused all retirement financial savings.

The outcomes held agency all through every state of affairs – the continued contributor all the time got here out on prime. Why? Primarily from the compounding impact that takes place. The preliminary $500 funding wasn’t substantial, however the compounding curiosity over time took off.

Ought to Buyers Money Out Throughout A Bear Market?

Buyers ought to by no means money out their 401(okay) for the only real objective of avoiding loss throughout a bear market. In spite of everything, the implications are steep. The one approach to assure a loss throughout a bear market is to withdraw your investments from their automobiles. Technically, the market developments up excess of it developments down. Even within the “down instances,” the market tends to recoup its losses in time.

By eradicating your financial savings or “cashing out” prematurely, you get rid of the potential of recouping any losses you will have incurred through the downturn. The most suitable choice is to hold tight and journey the wave; the loss is barely actual in the event you take away your investments. Till then, your portfolio sometimes holds a 75% likelihood of retaining a constructive return in the long term.

Defending Your Retirement Financial savings Throughout A Recession

The shocking reply to defending your retirement financial savings is to not panic. Reject the urge to let a downturn affect your decision-making. Retirement financial savings is a long-term play, one which has time on its aspect.

Another methods to guard your investments embody

-

Portfolio diversification: The way you allocate your belongings can mitigate dangers and bolster your portfolio returns.

-

Portfolio rebalancing: Bringing your portfolio again into its authentic kind may also help with publicity to undesirable danger ranges and maximize returns.

-

Proceed Contributing: Whereas pausing 401(okay) contributions aren’t as unhealthy as cashing out, it has its personal unfavorable penalties. Even a brief pause can imply 1000’s in missed funds.

The Backside Line

Time is the good equalizer on the subject of retirement financial savings, shares will proceed to be unstable, fluctuate and check your persistence however these that may persist with a plan see the most effective outcomes. If all else fails, it is best to remain in your present 401(okay) funding path. Be sure that to attach with a monetary advisor that will help you plan accordingly.

Ideas for Defending Your 401(okay)

-

Take into account speaking to a monetary advisor about funding methods and defending your 401(okay). Discovering a professional monetary advisor would not should be onerous. SmartAsset’s free device matches you with as much as three monetary advisors who serve your space, and you’ll interview your advisor matches for gratis to resolve which one is best for you. For those who’re prepared to search out an advisor who will help you obtain your monetary objectives, get began now.

-

A target-date fund will routinely rebalance over time. This can make sure you stay primarily invested in shares early in your profession. Then, as you close to retirement, it will shift to safer, extra conservative investments.

Picture credit score: ©iStock.com/Sezeryadigar, Picture credit score: ©iStock.com/ AndreyPopov

The publish Ought to You Pause 401(okay) Contributions in a Bear Market? Morningstar Compares Options appeared first on SmartAsset Weblog.

Source link