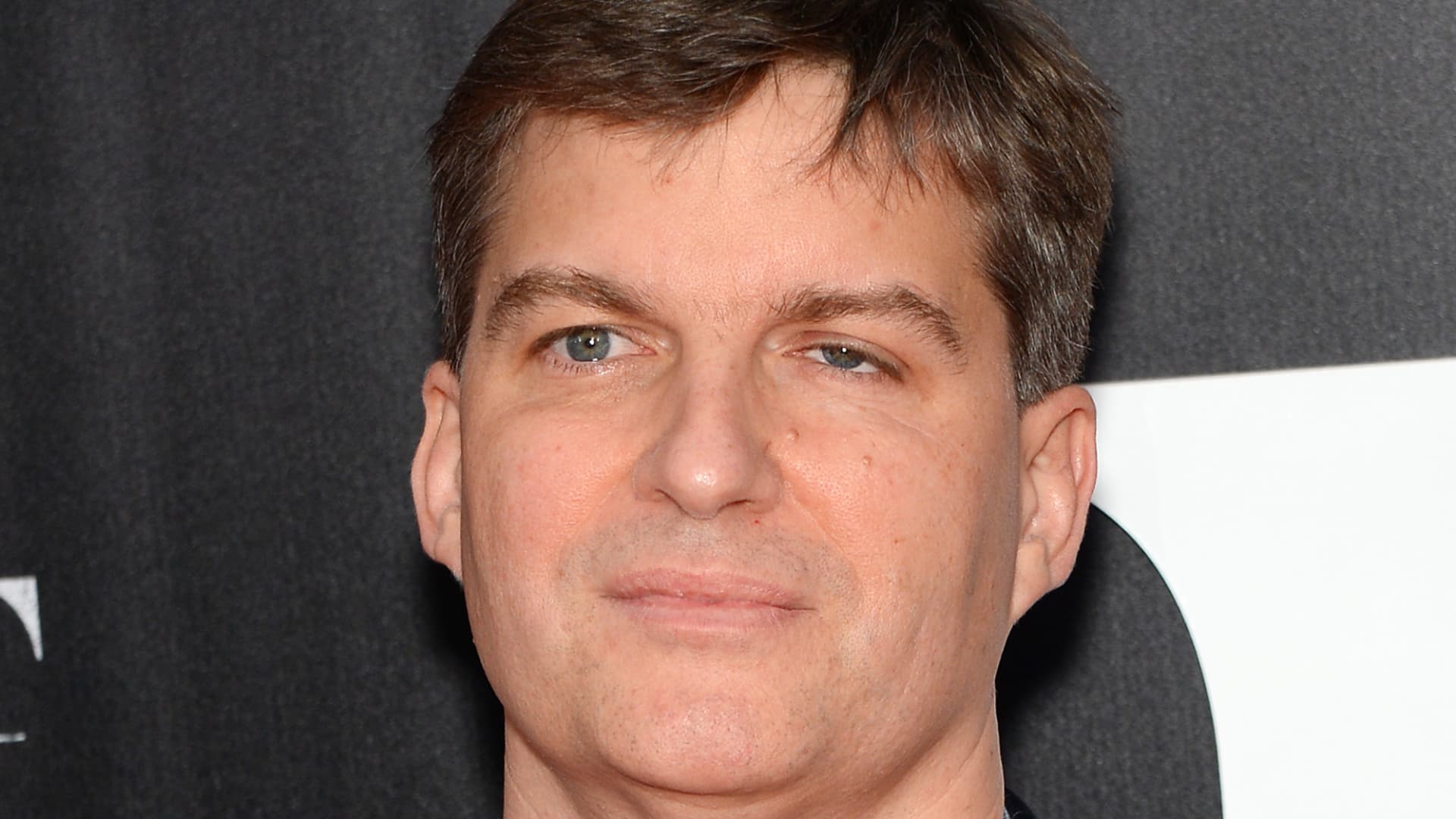

‘The Huge Quick’ investor Michael Burry says 2022 is like ‘watching a aircraft crash’

[ad_1]

“The Huge Quick” investor Michael Burry, recognized for calling the subprime mortgage disaster, is drawing parallels between at this time’s market surroundings and that of 2008, saying it is like “watching a aircraft crash.” Burry, who now runs a hedge fund at Scion Asset Administration, struck a pessimistic tone in a tweet Tuesday because the sell-off resumed on Wall Road. The famed investor’s portfolio final quarter revealed a few of his bearish outlook available on the market. Burry owned 2,060 put contracts on Apple — a guess in opposition to the largest U.S. firm by market cap — on the finish of the primary quarter, a regulatory submitting confirmed. To make sure, Burry is a really lively dealer and he may have exited this place by now. But when he held onto these places, the guess would have been worthwhile as Apple has fallen one other 20% within the second quarter, bringing its 2022 losses to almost 22%. Burry declined to remark. The investor shot to fame by betting in opposition to mortgage-backed securities earlier than the collapse of the mid-2000s housing bubble. Moreover his “Huge Quick,” Burry made a killing from an extended GameStop place final 12 months because the Reddit favourite made Wall Road historical past with its large brief squeeze. The market has been in turmoil this 12 months because the Federal Reserve’s aggressive tightening measures to tame inflation stoked fears of a recession. In the meantime, buyers are additionally on edge in regards to the battle in Ukraine , the pandemic ‘s path in China and world provide chain points. The S & P 500 is down about 18% in 2022, and the fairness benchmark briefly dipped into bear market territory final week.

Source link