Financial institution of America says a “wealth impact on steroids” might impression the U.S. financial system on account of the autumn within the worth of shares and bonds and different belongings value trillions of {dollars} in 2022.

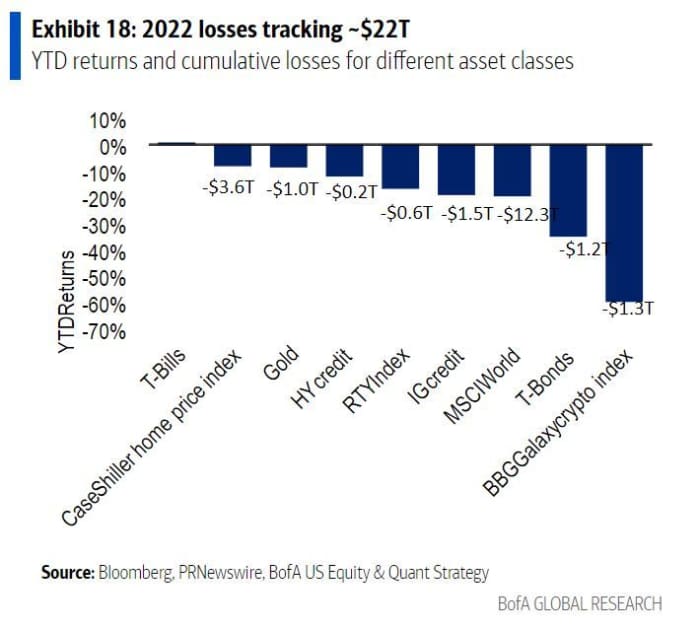

“The $22 trillion misplaced in equities, bonds, cryptocurrencies and actual property this yr would characterize a few $700 billion hit to consumption, which represents about 4% of whole present consumption, plus or minus,” stated a workforce of strategists led by Savita Subramanian, the financial institution’s head of U.S. fairness & quantitative technique, in a observe to purchasers Monday.

Financial institution of America

Subramanian was utilizing a calculation from the Nationwide Bureau of Financial Analysis (NBER), which has discovered that one greenback of wealth destroyed interprets right into a ballpark 2% to 4% hit on consumption.

The NBER defines the so-called wealth impact as the concept that households turning into richer owing to rise asset values, similar to shares or actual property will spend extra and in flip stimulate the broader financial system. That wealth impact can even unravel in powerful occasions.

Learn: Inventory-market buyers ought to ‘concentrate on the marathon, not the dash,’ says Financial institution of America, positing an S&P 500 at 6,000 by 2032

Down 16% to this point this yr, the S&P 500

SPX,

-0.16%

is headed for its worst efficiency because the top of the Nice Monetary Disaster in 2008. And actual property costs have been underneath strain this yr amid larger U.S. rates of interest and fears of a recession.

Subramanian and the workforce say the $700 billion determine could also be overstating the impression “provided that U.S. customers maintain part of these devices.” However the the wealth impact could possibly be extra pronounced as a result of a “extra democratized market,” she stated.

Democratized investing amped the wealth impact of the 2000s, owing to broadening dwelling possession. A subsequent $8 trillion loss in family web value owing to the 2008 crash had a knock-on impact of as a lot as 1 percentetage level quarter on quarter on a seasonally adjusted fee on the peak.

As for the present local weather, they see indicators of democratized investing by way of retail investing that whereas down from late 2020/early 2021 highs following peak fiscal stimulus, remains to be larger than pre-COVID. They estimate it contains round 20% of enormous capitalization and 28% of small-cap buying and selling volumes.

BofA

Extra proof: customers of buying and selling platform Robinhood

HOOD,

-0.11%

are additionally above pre-COVID ranges, even when down from peaks. And deal values surged in 2021, with round 60% of that by way of particular goal acquisition automobiles (SPACs).

Subramanian additionally famous a June survey by BofA’s cryptocurrency strategists that discovered 43% of respndents deliberate to provoke crypto holdings over the subsequent six months, and 75% had been planning so as to add extra over the subsequent six months.

In fact, that survey got here earlier than the chapter of crypto alternate FTX and extra just lately BlockFi. Stress in that asset class has saved bitcoin

BTCUSD,

+2.47%

at lows not seen since late 2020.

Opinion: As crypto losses and alternate failures mount, right here’s how tax consultants say to make the most effective of it

And: Crypto lender BlockFi is suing Sam Bankman-Fried over his shares in Robinhood: report